CURRENCY UPDATE

Dollar Poised for Third Straight Gain Before Jobs Report

January 08, 2026

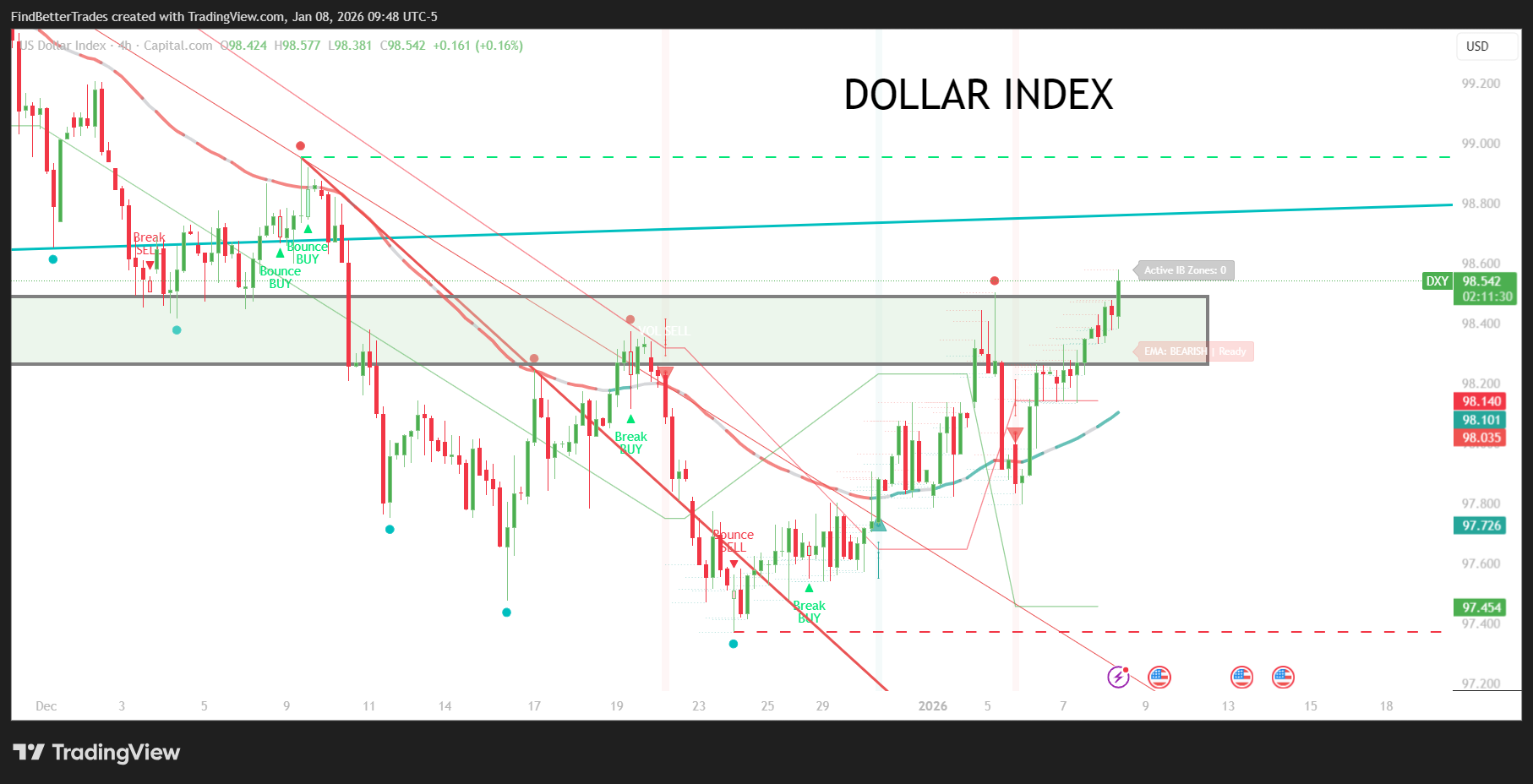

DOLLAR'S THIRD STRAIGHT DAILY GAIN

The dollar index was up 0.06% at 98.793, poised for its third straight daily rise though mixed U.S. economic data left markets cautious ahead of Friday's nonfarm payrolls report.

Data Thursday showed the labor market appeared stuck in a "no hire, no fire" state, with job openings falling more than expected in November while hiring eased. However, services sector activity unexpectedly picked up in December, suggesting the economy ended 2025 on solid footing.

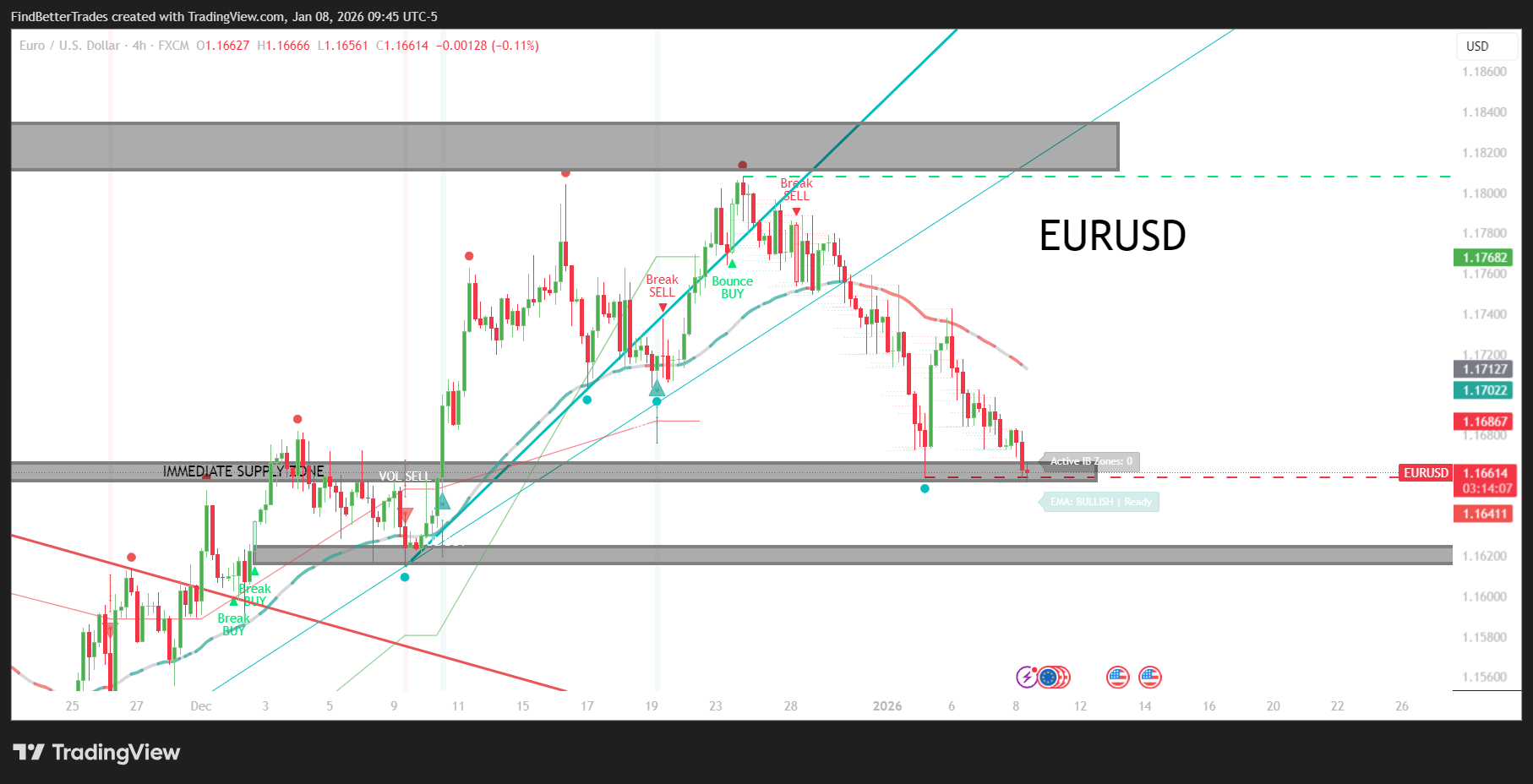

EURUSD: VALID SUPPORT AT 1.1660

The Euro trades around a valid support level resting at 1.16600. With bullish expectations increasing, price could hold this level before making a push to the upside. However, bias remains mixed as the dollar continues to dominate.

The euro was down 0.05% at $1.1669 on Thursday after dropping 0.45% in the last two sessions. Recent soft inflation figures drove the currency lower and German Bund yields to a one-month low. "Soft European inflation reinforces dovish sentiment, while the Greenland crisis underscores Europe's relative vulnerability, potentially triggering further euro selling," said Olivier Korber from Societe Generale.

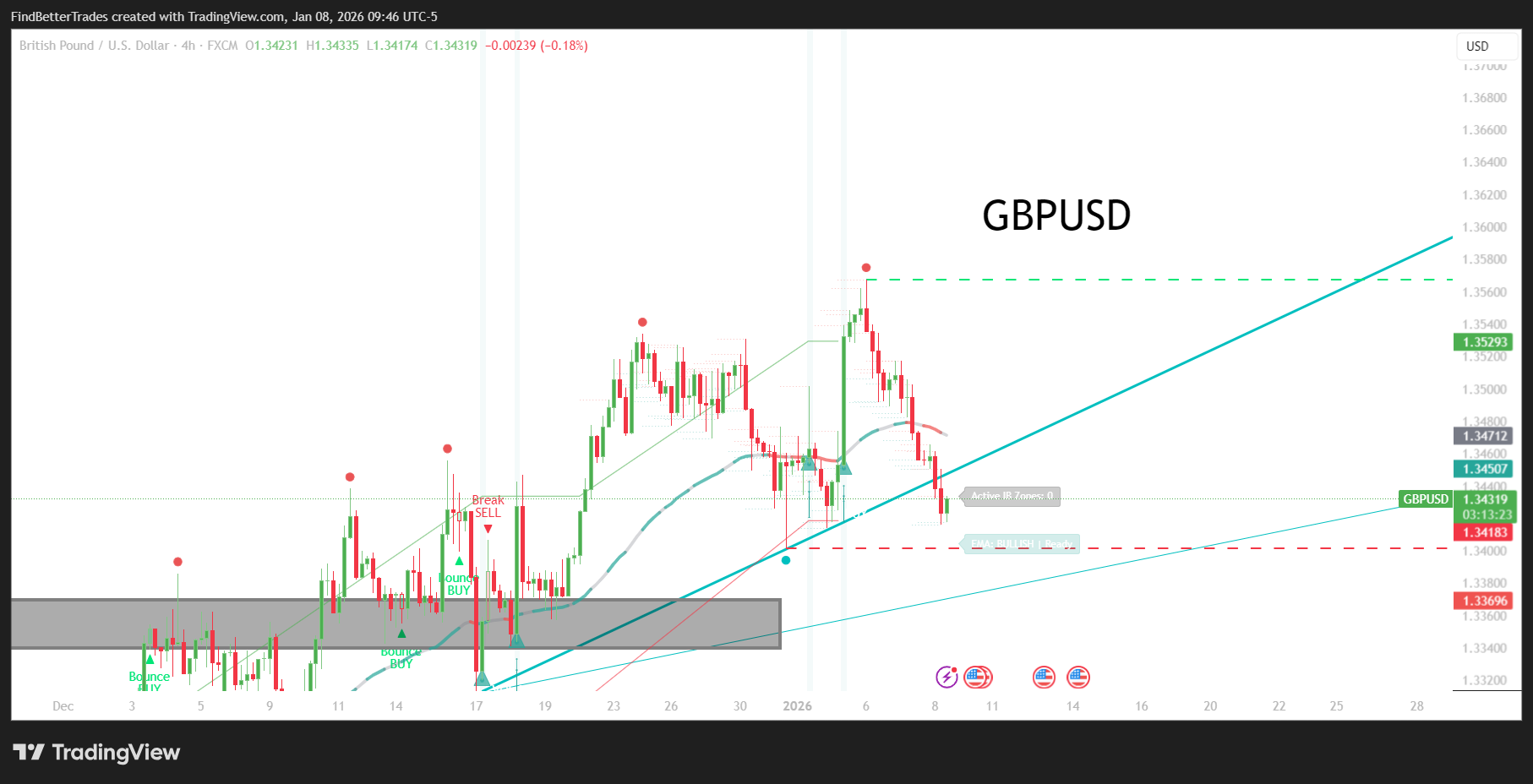

GBPUSD: SELLING MOMENTUM SHIFTS

The Pound also traded to the downside this week, although the selling momentum has shifted with bias moving to the bullish side. Expectation that price could take a turn after holding above 1.34000 is likely.

Sterling was down 0.1% at $1.3444, set for a third consecutive decline versus the strengthening dollar, after hitting $1.3567 on Tuesday – its highest level since September 18. However, analysts said market participants had been too gloomy about UK growth outlook and sterling might perform better than expected in 2026 amid fewer economy concerns.

"If we look at the pound's performance right at the start of the year, it's doing really quite well even though there wasn't an awful lot of data," said Jane Foley from Rabobank. "I think that is still a response to the fact that ahead of the budget the market had built up an awful lot of short positions."

GBPJPY: CORRECTION FROM 212 HIGHS

The Pound-Yen traded to the upside pushing above 212 before making a corrective move back into 210.50. The bullish bias cannot be denied although traders are calling for a retracement into 207 before this move occurs.

The yen was roughly unchanged at 156.70 per dollar. "For those hoping for significant yen appreciation, the only option for now is to wait for the conflict with China to cool down again," said Michael Pfister from Commerzbank, warning that a complete Chinese export ban on rare earths could deal a significant blow to the yen.

GOLD: CORRECTION FROM $4,490 HIGHS

Gold traded into the $4,490 level before making a short-term correction back below $4,430. The bias is still on the bullish side. If price trades above the high of $4,550, there could be a continuation of gold's rally to start the first quarter.

The precious metal's consolidation reflects healthy profit-taking after its extraordinary 2025 performance, though the underlying bullish momentum remains intact as geopolitical tensions and central bank buying continue.

BITCOIN: DEEPER CORRECTION TO $89K

Bitcoin opened the week trading into $94K before making a deeper correction back into the $89K level. Bias remains mixed as traders are looking for a push into $100K to start the year. Would this drop become a correction for a continued rally or would price head lower into the $70K zone?

This critical juncture will determine Bitcoin's trajectory for early 2026. The failure to hold $90K raises concerns about institutional demand, though some view current levels as accumulation opportunity before a potential $100K push.

FED RATE CUT EXPECTATIONS

Traders are pricing in at least two rate cuts from the Federal Reserve this year, although the divided central bank indicated in December there would be only one cut in 2026. The Fed is expected to keep rates steady at its meeting this month.

This disconnect between market expectations and Fed guidance creates uncertainty about the dollar's path forward.

LOOKING AHEAD TO JOBS REPORT

Friday's nonfarm payrolls report will be crucial for determining near-term dollar direction. Can the euro hold support at 1.1660 before the expected push higher? Will sterling's bullish bias materialize after holding above 1.3400?

The GBPJPY's correction from 212 to 210.50 and potential retracement to 207 offers tactical opportunities before the next bullish leg. Gold's consolidation below $4,430 sets up a potential breakout above $4,550 if first quarter momentum builds.

Bitcoin's position at $89K represents a critical decision point. The $100K target for early 2026 looks increasingly ambitious unless buyers step in forcefully at current levels. Failure to hold support could indeed trigger the feared move toward $70K.

With the dollar notching its third straight daily gain despite coming off its worst year since 2017, markets await Friday's jobs data to determine whether this rebound has legs or represents just a temporary correction in the longer-term downtrend. The combination of mixed economic data, geopolitical tensions over Greenland, and fiscal concerns ensures volatility will remain elevated as 2026 gets underway.

TerraLine Shows Structure. Prime Alerts Bring It To You.

You already have the indicator. Now get the setups delivered.

Real-time Terra Structure alerts on stocks, crypto, commodities.

Every Alert Includes: ✓ Setup type (bounce buy, bounce sell, break buy, break sell) ✓ 3 support levels mapped ✓ 3 resistance levels mapped ✓ How to frame the trade

Upgrade Now: $197 Lifetime

Private Telegram room. Live analysis. New updates first.

Kind regards,TradingStrategyGuides