How to Trade Ethereum (Beginner’s Guide in 2025)

How to Trade Ethereum: Full Beginner’s Guide and Best Places to Buy ETH

Ethereum has once again captured the spotlight. With prices pressing near all-time highs and trading volume hitting record levels, ETH has become one of the most closely watched assets in global markets. Whether you’re here to invest, actively trade, or simply understand how Ethereum works, this guide will walk you through everything from market access to strategies, common mistakes, and where you can actually spend your ETH.

Why Ethereum is in the Spotlight Right Now

Ethereum’s recent surge has been fueled by several factors working in its favor. DeFi adoption continues to grow, bringing millions of users into applications that run on Ethereum’s network. NFT markets, while volatile, are still driving demand for ETH as the primary payment currency. On top of that, Ethereum’s long-planned scalability upgrades are increasing optimism about lower transaction costs and faster settlement times.

This mix of real-world utility, investor interest, and technological development has pushed ETH trading volume higher and drawn in both retail traders and institutional players. For anyone looking to participate, understanding where and how to buy Ethereum — and how to trade it wisely — is essential.

The Best Tool for Trading Ethereum Right Now

When Ethereum is pushing all-time highs, the speed and accuracy of your trade entries matter more than ever.

That’s where our Support and Resistance scanner at FindBetterTrades Scanner comes in.

This scanner is built to track Ethereum’s key support and resistance levels in real time, then alert you the moment a breakout occurs. In the chart above, you can see how the scanner identified the exact breakout zone near $2,800 — well before ETH ripped past $4,000 and into fresh highs. It’s designed to filter out noise, so you’re not chasing random price spikes or false moves.

What makes it so effective is its focus on smart-money levels. It’s not looking for every little wiggle on the chart — it’s locking in on the points where institutions and high-volume traders are likely to step in. When those levels break, the scanner fires a clear “Breakout Buy” or “Breakout Sell” signal, so you can act with confidence.

For Ethereum traders, this means:

- No more staring at charts all day waiting for confirmation.

- Clear entry points with built-in breakout validation.

- The ability to react instantly when ETH moves — whether that’s a bullish run toward new highs or a sudden reversal.

If you want to trade Ethereum like a pro during this record-setting run, having the Breakout Scanner in your toolkit can make the difference between catching the move early and watching it from the sidelines.

CLICK HERE TO GET THE SCANNER!

Best Places to Buy Ethereum

Choosing the right exchange matters. You want a platform that’s easy to navigate, secure, and offers reliable liquidity. These are some of the most trusted options for getting started:

Coinbase is one of the most popular crypto exchanges worldwide, known for its simple setup process and strong security measures. You can deposit with a bank account, debit card, or PayPal (in eligible regions), making it convenient for first-time buyers. Those seeking advanced trading tools can use Coinbase Advanced.

Kraken has built its reputation on security and transparency. With competitive fees and a wide range of supported cryptocurrencies, it appeals to both casual buyers and seasoned traders. Kraken also offers ETH staking directly on the platform for those interested in earning rewards.

Gemini provides a regulated, user-friendly environment for buying Ethereum. Its Gemini Earn feature allows users to earn interest on ETH holdings, and the exchange is known for prioritizing compliance and safety.

eToro blends crypto investing with traditional markets, allowing you to buy Ethereum alongside stocks and ETFs. Its social trading feature lets you follow and copy strategies from top investors.

Bitstamp is one of the industry’s longest-running exchanges. It has competitive fees, a clean interface, and a strong reputation for customer support — making it a reliable choice for both European and global traders.

Crypto.com offers a mobile-first experience with low fees, a crypto debit card, and integrated DeFi access. You can also stake ETH through the app for additional yield.

All of these platforms allow you to purchase Ethereum directly with your local currency and then store it securely in your own crypto wallet.

How to Trade Ethereum (Beginner’s Guide)

Ethereum trading simply means buying and selling ETH to profit from price movements. While some traders focus on short-term moves, others take a longer-term investment approach. ETH can be traded through spot markets, futures, options, ETFs, and even indirectly via blockchain-focused company stocks.

Step-by-Step Approach to Trading ETH

Start by assessing your financial goals and risk tolerance. ETH is known for significant volatility, so you need to be comfortable with price swings. Next, research the factors driving Ethereum’s price — this could include network upgrades, DeFi trends, NFT adoption, or broader crypto market sentiment.

With a market view in mind, decide whether to trade directly on a spot exchange, speculate with futures, gain exposure through an ETF, or use options for more complex strategies. Once you’ve chosen your method, identify trade opportunities using technical analysis, fundamental research, or both.

When entering a trade, have a clear plan: where you’ll take profits, where you’ll place a stop-loss, and under what conditions you’ll exit. Actively monitor your position, as market conditions can shift quickly. Finally, review each trade afterward to refine your approach.

Common Mistakes to Avoid When Trading Ethereum

New traders often get caught chasing the price after big moves, buying high and selling low. Others overlook fees, which can eat into profits, especially on smaller trades. Not securing ETH in a personal wallet is another frequent error, leaving funds vulnerable on exchanges. Overusing leverage without understanding the risks can lead to quick losses, as can skipping basic risk management like setting stop-loss orders.

Best Ethereum Wallets

Owning ETH also means keeping it safe. Many traders store their Ethereum in secure, private wallets rather than leaving it on exchanges. Hardware wallets like Ledger Nano X and Trezor Model T provide offline security. MetaMask is a popular browser wallet for interacting with DeFi and NFTs. Trust Wallet offers mobile convenience, and Coinbase Wallet connects directly to the Coinbase ecosystem while still giving you control of your keys.

Where You Can Spend Ethereum

Ethereum isn’t just for trading — it’s increasingly accepted for real-world payments. You can book hotels and flights through platforms like Travala, pay select Shopify merchants directly, or use services like Bitrefill to convert ETH into gift cards for Amazon, Starbucks, and more. As adoption grows, ETH’s role as both a store of value and a medium of exchange continues to expand.

How to Trade Ethereum

Ethereum is considered to be the next bitcoin. In this article, we’re going to show you how to trade Ethereum. If you’re reading this article, you’re probably familiar or interested in trading cryptocurrencies.

It’s never too late to start trading Ethereum. You can trade it for massive profits because ETH remains one of the most undervalued cryptocurrency. Many people are asking if it’s too late to invest in Ethereum and whether or not we’ve missed the bus.

In the crazy old days, we saw Ethereum price reaching an all-time high of $1420. Our team at TGS believes that the current bear cryptocurrency market is giving us another great buying opportunity.

Has Ethereum reached its peak potential in both the technology itself and the overall market cap? This is the most important question we have to ask ourselves.

If you believe Ethereum has reached its absolute peak, then investing in Ethereum can be too late. However, if you still believe there is room for growth, like our team at Trading Strategy Guides, then you should consider investing in Ethereum.

The most important thing when trading Ethereum or any other cryptocurrency is to make sure you stay in the game.

What is Ethereum?

Ethereum was created in 2015 and is a global, open-source platform for decentralized money and applications that lets users to write code that controls values, runs programs, and is easily accessible around the world. Ethereum is designed specifically to run without being controlled by a government or person. In this article, we’re going to discuss all things Ethereum (ETH).

Ethereum is an open-source, public, blockchain-based distributed computing platform. It features smart contract functionality. In other words, Ethereum is a digital currency. It’s a way of transferring value from one person to another person.

Ethereum is a different type of blockchain the same like Bitcoin has its own blockchain. The Ethereum blockchain has its own currency which is called Ether. The difference between Ethereum and Bitcoin is the proof of stake. And the fact that Ethereum has real people behind it.

The most significant difference is the use of smart contracts. This has allowed other intelligent people to implement different cryptocurrencies based on the Ethereum blockchain.

The amount of transaction that Ethereum blockchain can process, or the average block time is around 12 – 15 seconds which is faster than Bitcoin.

How to Trade Ethereum

Buying Ethereum can be extremely simple. But it can also be a little bit daunting for the non-technical people. The process of buying Ethereum can be done quickly through an exchange where Ether is listed.

The easiest way to buy Ethereum is to use a cryptocurrency exchange called Coinbase. You can get an account set up in minutes. You can check it out here to get yourself signed up.

Another great way to buy and sell Cryptocurrency is called Binance. Binance are known for their strong team, proven products, superior technology, and industry resources. They have a solid relationship with industry leaders and are capable or 1,400,000 orders per second. This is by far makes them the fastest exchange in the market today. You can sign up with them here. It only takes a minute.

You can buy Ethereum directly with fiat money from the major cryptocurrency exchanges.

However, you also have the option to buy Ether with Bitcoin or other major cryptocurrencies. Such as Litecoin or Ripple.

All you have to do is to register a free account with any of the crypto exchanges. Then deposit fiat and buy Ethereum through the platform.

Note: Before you start trading Ethereum, you should keep in mind that the crypto market is extremely risky. It is volatile and we believe a lot of the market is just driven purely by speculation.

Top Ethereum Trading Apps

Similar to many other blockchains, Ethereum has a native currency called Ether (ETH) which is that is completely digital which allows it to be sent to anyone around the world with the click of a button, making payments with the ETH currency incredibly efficient and easy. Since Ethereum can be programmed, developers use Ethereum to build new kinds of decentralized applications (dApps) that offer an array of features to help track and manage currency.

Ethereum Apps & Wallets:

- Metamask: The MetaMask app is your Ethereum wallet manager that stores your Ethers, allowing you to send and receive Ethers.

- Status: Is an Ethereum mobile browser token wallet, chat, and dApp portal for users to efficiently store and send Ethereum.

- uPort: uPort is an app that provides is an Ethereum address that allows users to interact with other Ethereum and exchange information privately.

- Brave: Is a fast, open source, privacy-focused web and mobile browser that is integrated with BAT and ERC-20 tokens.

- Trezor: Trezor is one one of the top Ethereum hardware wallets with a high level of security and 2-factor authentication. Trezor’s offline feature allows people to access their currency. Users have access to special features like advanced cryptography, and even allows you to edit transaction before sending them out.

- Coinbase Wallet: Is an Ethereum is another popular mobile browser with a token wallet, chat, and dApp portal.

- MyEtherWallet: MyEtherWallet is one of the top Ether wallet where users can access their tokens, loans and investments.

- Balance: Balance allows users to see their account in Open Finance while keeping track of your tokens, loans and investments.

Once “dApps” are uploaded to Ethereum, they are able to control digital assets that can create new types of financial apps. The apps also branch to additional platforms such as cryptocurrency wallets, decentralized markets, and even games. It redefines how traditional blockchains function. Checkout more Ethereum based apps here!

The BEST Ethereum Trading Strategy Today (SIMPLE RULES)

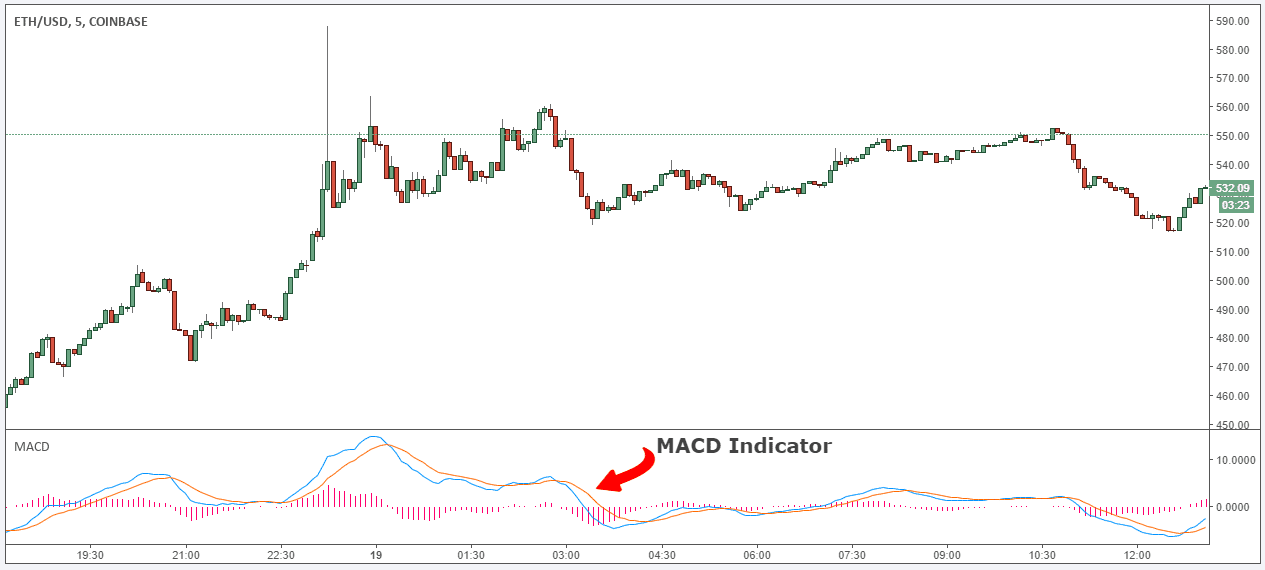

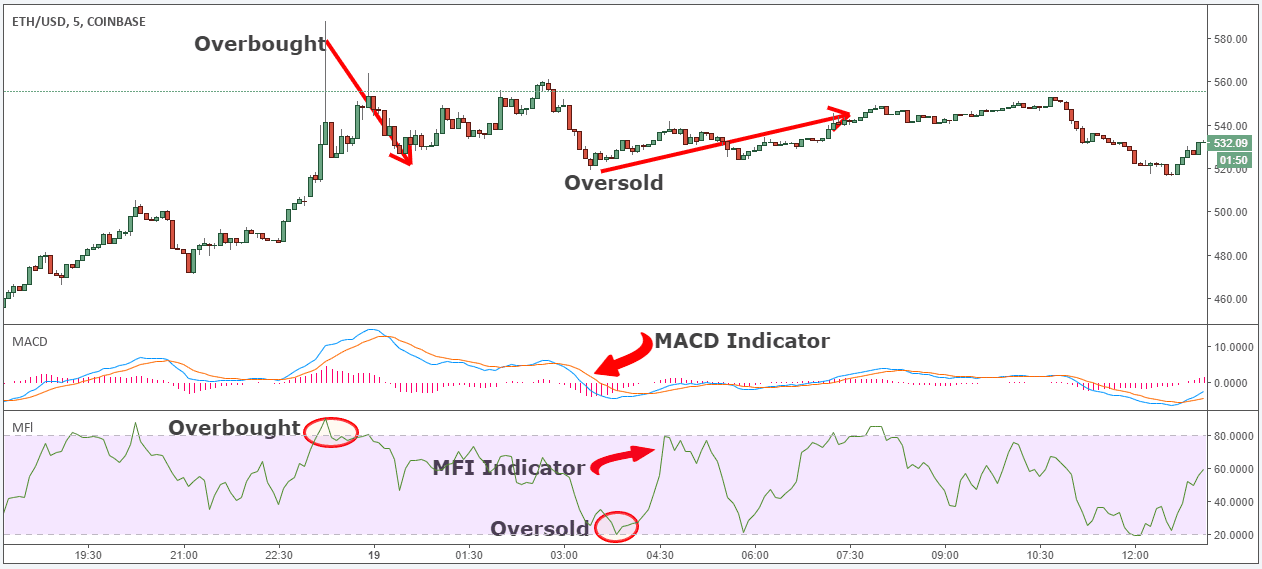

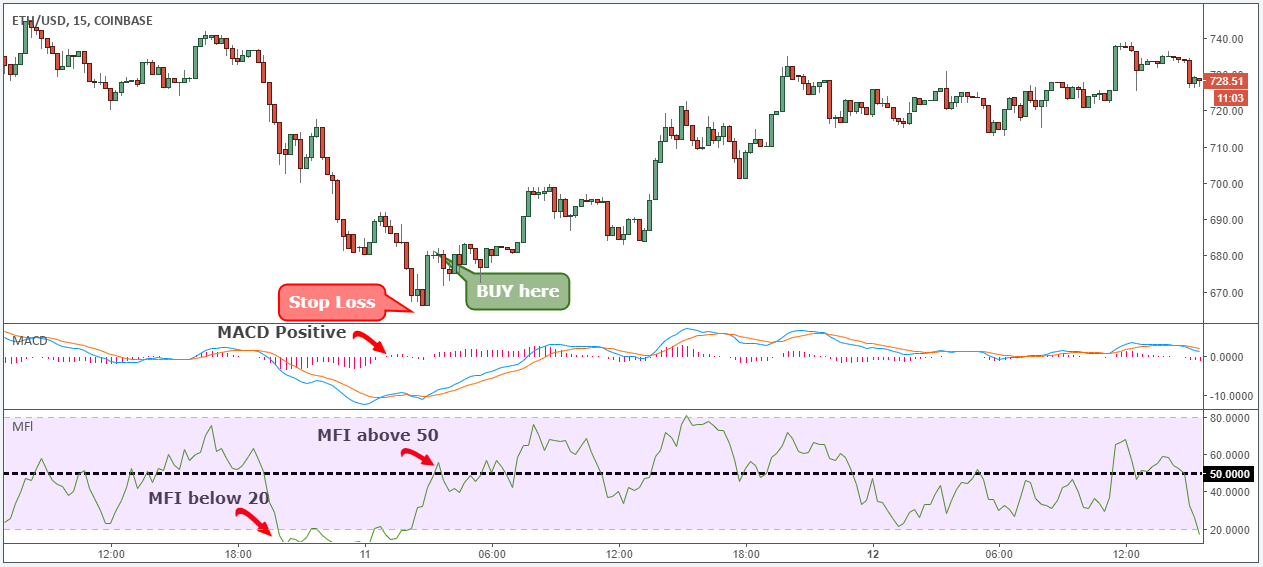

In this section, we’ll be looking at some Ethereum trading strategies. This will help us make profitable trading decisions. All we need for this trading strategy is two technical indicators:

- The MACD – This is a momentum indicator that can help us spot a trend.

- The MFI or the Money Flow Index is an overlooked but critical technical indicator. It measures the money flow into or out of a cryptocurrency.

THE ETHEREUM MACD SUPER BOUNCE STRATEGY

The MACD is one of the most common indicators used by traders around the world. It works in a variety of different markets and is used to spot trades before they happen. Our team at TSG has written extensively about how to properly use the MACD indicator. It can be found in our top awarded strategy MACD Trend Following Strategy.

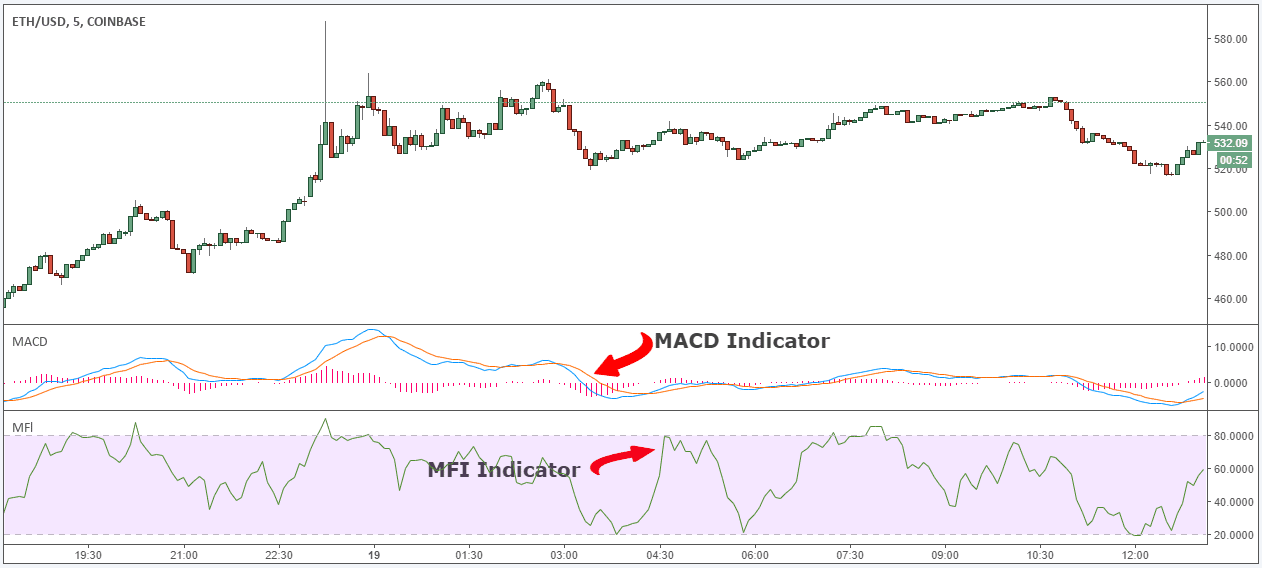

The MFI indicator is based on price action. It incorporates Volume in its calculation, which is quite similar to other oscillators. In other words, we can use the MFI indicator to measure buying and selling pressure.

We can use the MFI indicator to trigger entries and to take profits.

The easiest way to interpret the MFI indicator is that a reading above the 50 level represents an inflow of money into the cryptocurrency. A reading below the 50 level represents an outflow of funds from the cryptocurrency.

The other critical MFI thresholds are 20 and 80. An MFI reading of 20 is considered bullish and oversold. A reading above the 80 level is considered bearish and overbought.

The MFI measures the market sentiment giving you signs. These signs are whether the cryptocurrency is oversold or overbought and to what degree.

Using the MFI indicator is probably the most useful measurement of sentiment available to traders.

Let’s now take one step forward and see how you can make money applying Ethereum trading strategies.

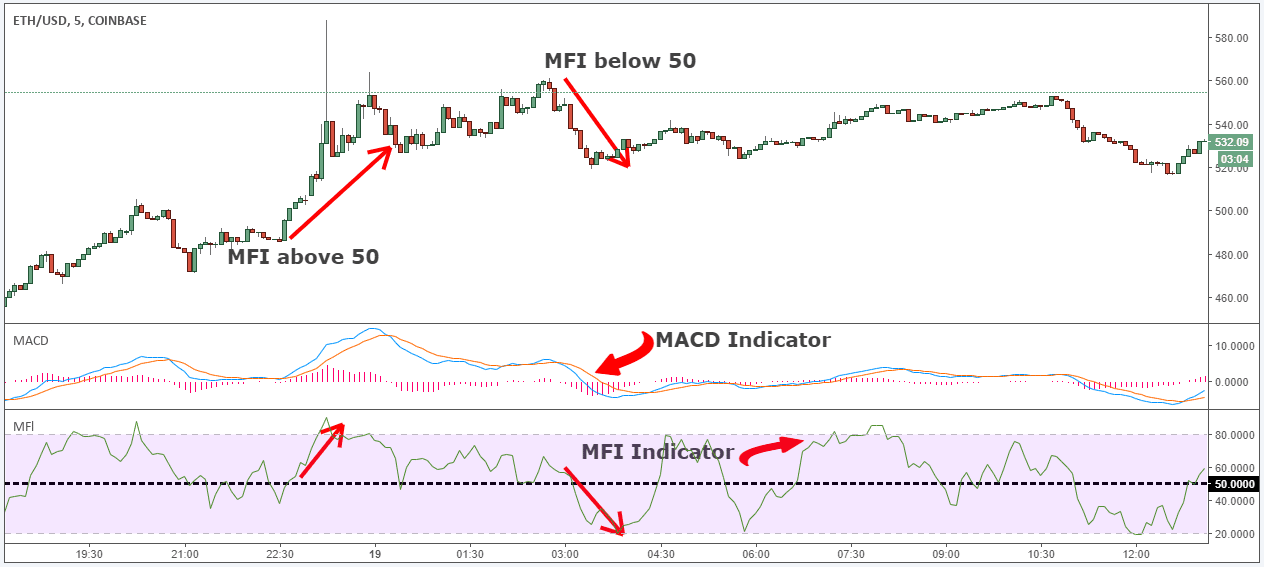

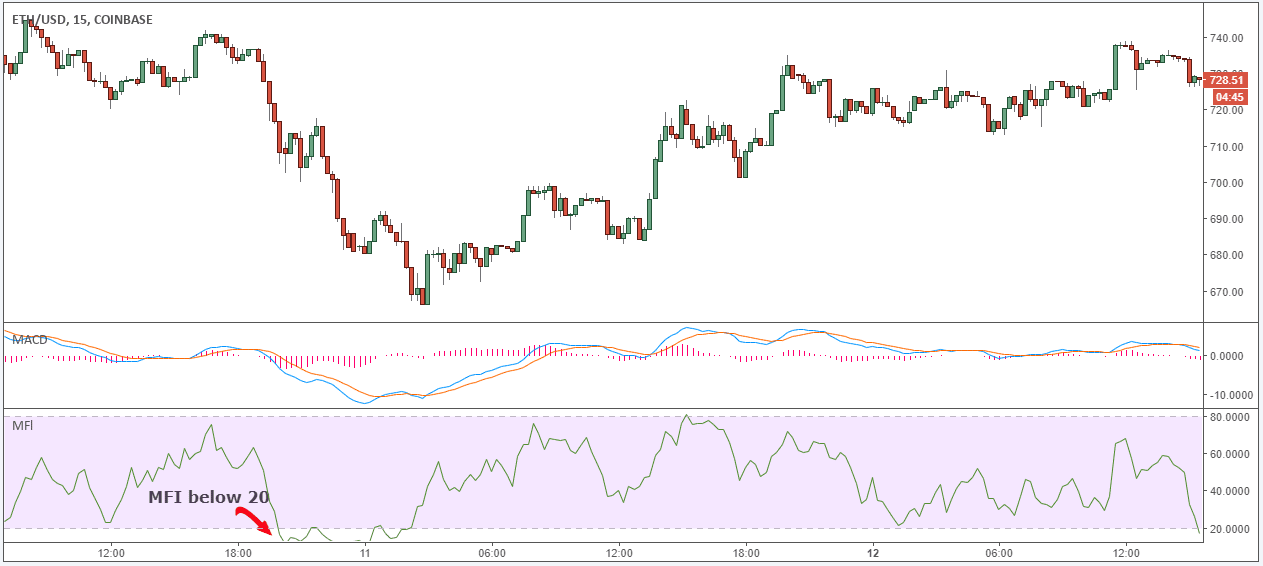

Step #1: Wait until the Money Flow Index drop below the 20 level.

The first rule is that you always want to wait for the Money Flow Index to be in oversold territory. In other words, we need to have an MFI reading below the 20 level.

An extreme MFI reading below 20 suggests that there is very heavy money outflow from Ethereum. As history has repeatedly shown, this information can be used as a contrarian indicator.

The MFI indicator is not a standalone indicator. There are plenty of good cryptocurrencies that have high MFI reading, and most bad ones have low MFI reading.

So, in order to use the MFI indicator, we need to check it against other technical indicators. These are the reason why we also use the MACD indicator.

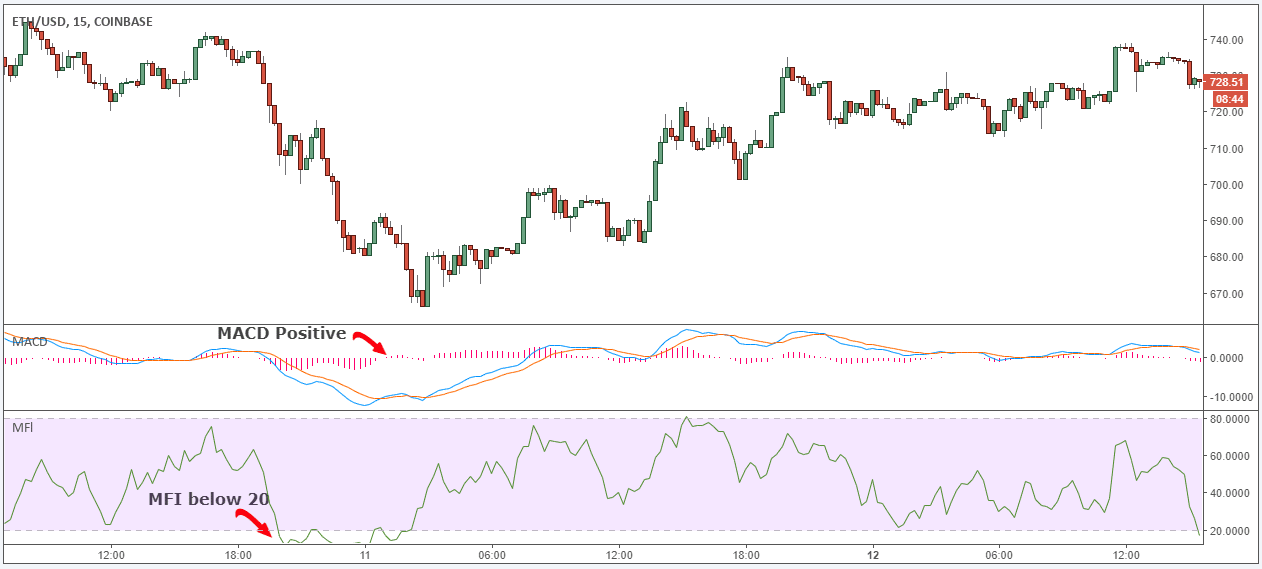

Step #2: Wait for MACD histogram to break above the zero level

The second rule is to wait for the MACD histogram to turn positive. This is a confirmation that the bullish momentum is starting to build up. Now, we have two rules in place, but these are still not enough to trigger an entry.

Indicator-based strategies are very unpredictable. This is the reason why we’ve added another confirmation signal before to enter and buy Ethereum.

Now, we’re going to lay down a straightforward entry technique for Ethereum trading system.

See below…

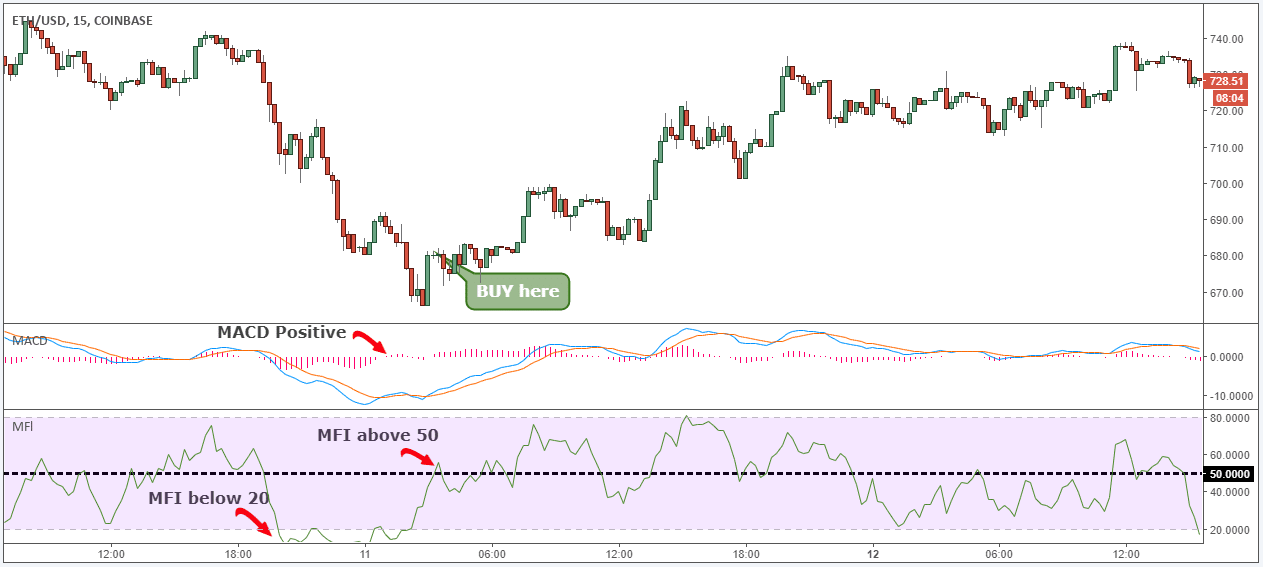

Step #3: After MACD turned positive, Buy after MFI also breaks above the 50 level.

As an extra measure of caution, we also like to wait for the MFI indicator to break above the 50 level before to buy Ethereum.

A reading above the 50 level represents an inflow of money into Ethereum. This is the moment when smart money is stepping into the market. We want to trade alongside smart money to really make a profit trading the cryptocurrency market.

The next important thing we need to establish is where to place our protective stop loss.

See below…

Step #4: After Place Protective Stop Loss below the Previous Swing low

In order to minimize our potential loss, we want to place our protective stop loss very close to the market price. At the same time at a price where it should really invalidate our trade signal.

For the Ethereum strategy, the ideal place to hide the stop loss is just below the previous swing low. You can always add a buffer to protect yourself in case of a false breakout.

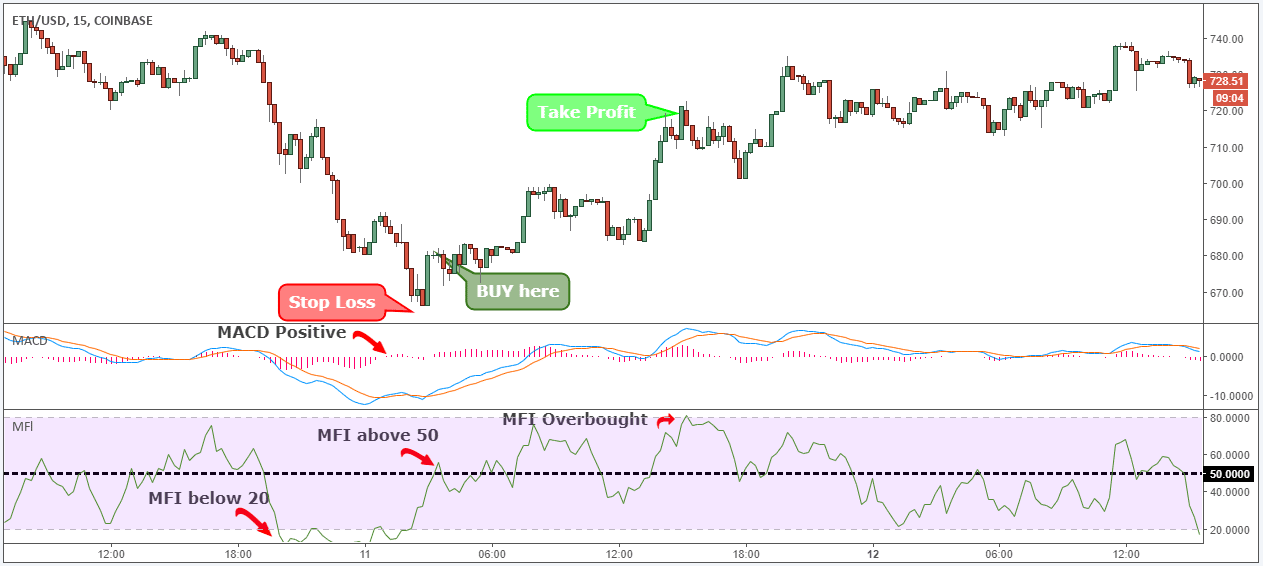

The next logical thing we need to establish for the Ethereum system is where to take profits.

See below…

Step #5: Take Profits when the MFI enters Overbought territory or above the 80 level.

When it comes to our Ethereum take profit trading strategy we want to cash some profits at the first sign that the market is about to turn against us. Otherwise, we risk given back some of our hard earned gains.

The first indication that the market is about to turn is when the Money Flow Index enters into overbought territory. In other words, when the MFI breaks above 80 levels, we take profits.

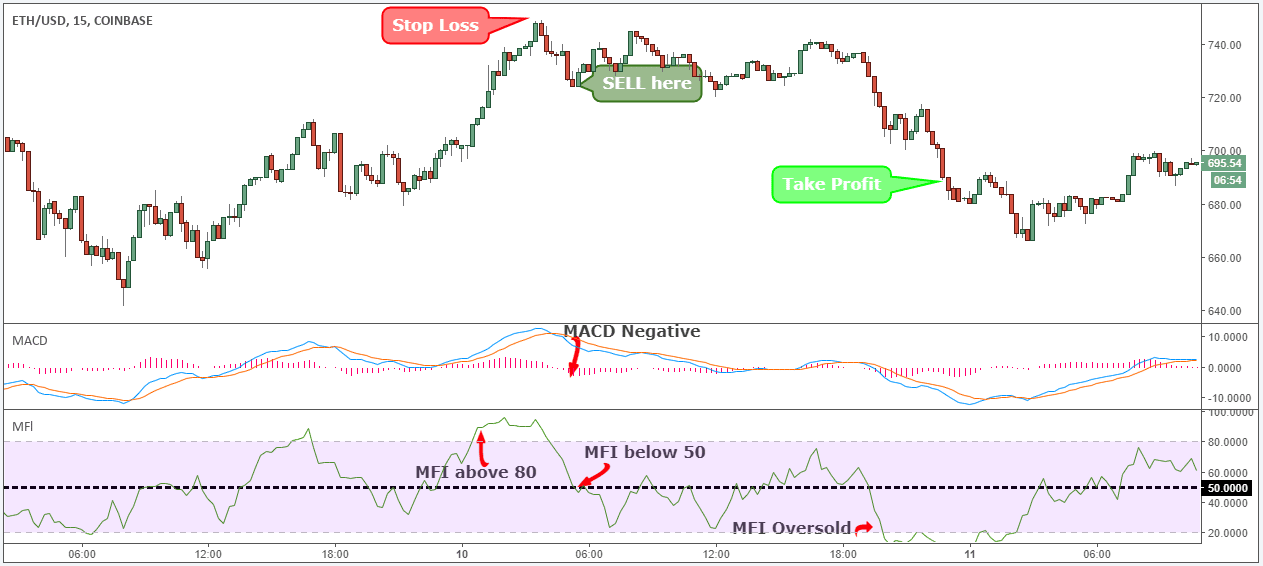

Note** the above was an example of a BUY trade using Ethereum trading strategies. Use the same rules for a SELL trade – but in reverse. In the figure below, you can see an actual SELL trade example.

How to Buy Ethereum

As you can imagine, the best way to get ETH is to buy it. There are countless cryptocurrency exchanges that will allow you to buy ETH depending where you live and how you would like to pay. You can find some of the top cryptocurrency exchanges and how to buy them here.

As you familiarize yourself with Ethereum and how it functions, who accepts it as currency, etc. you can purchase it through an exchange. For this, you’re going to want to purchase an Ethereum wallet so you can safely secure storage for your Ether or ERC20 tokens. Once you have chosen the wallet most appropriate for you and your needs, you’ll need to complete KYV/identity checks, choose a deposit method, once you deposited your funds, you’ll be able to buy ether with your deposited funds.

There are a handful of companies that accept Ethereum as a form of currency from airlines to pizza shops.

Conclusion

Some quick components to remember when it comes to Ethereum is that it is:

- A global, decentralized platform for money

- Writes code that controls money

- Allows for the construction of applications

- Utilizes blockchain technology

- A platform for the internet free from apps spying and stealing your information

Ethereum has fundamental advantages that hopefully will help Ethereum price suppress Bitcoin in the coming years. Trading Ethereum should only be done with money you can afford to lose. This is because the whole cryptocurrency market it’s mostly based off of speculation.

Nobody really knows what the potential is and what the future holds. But this doesn’t discourage us to adopt a positive mindset and hope for a bright cryptocurrency future.

Thank you for reading,

The Trading Strategy Guides Team