The most talked about stock on Wall Street: MSTR (Full Article)

MicroStrategy, Inc. (NASDAQ: MSTR) has become one of the most talked-about stocks on Wall Street, not for its legacy software business, but for its audacious pivot into Bitcoin. Once a quiet enterprise software firm, MicroStrategy transformed itself into a leveraged Bitcoin holding company under the leadership of its co-founder, Michael Saylor. This bold strategy has made MSTR’s stock a proxy for Bitcoin’s fortunes – soaring in bull markets and plunging in crypto winters. Investors are excited by MSTR because it offers amplified exposure to Bitcoin’s upside, wrapped in the familiarity of a publicly traded stock. But beneath the hype lies a complex web of financial engineering and risk.

In this deep-dive, we’ll explore the history of MicroStrategy and its stock, the reasons behind the investor excitement, and the red flags hidden in plain sight. We analyze when to buy or sell MSTR by examining both fundamental drivers and technical patterns. By the end, it should be clear why MicroStrategy might be a Bitcoin Icarus – a company flying high on digital gold wings that could melt if the narrative or market shifts.

Table of Contents

- Introduction

- From Dot-Com Darling to Bitcoin Proxy: A Brief History of MSTR

- Michael Saylor: The Cult of Personality Fueling the Hype

- Why Investors Are Excited About MSTR

- The “Intelligent Leverage” Strategy – A Closer Look

- A Precarious Capital Structure: Debt, Preferred Stock, and Dilution

- A Dying Core Business (The Elephant in the Room)

- SWOT Analysis of MicroStrategy (MSTR)

- Trading MSTR: Technical Trends and Timing Strategies

- When to Buy or Sell MSTR – Key Signals and Scenarios

- Conclusion: The MicroStrategy Maze – High Stakes, High Reward, High Risk

From Dot-Com Darling to Bitcoin Proxy: A Brief History of MSTR

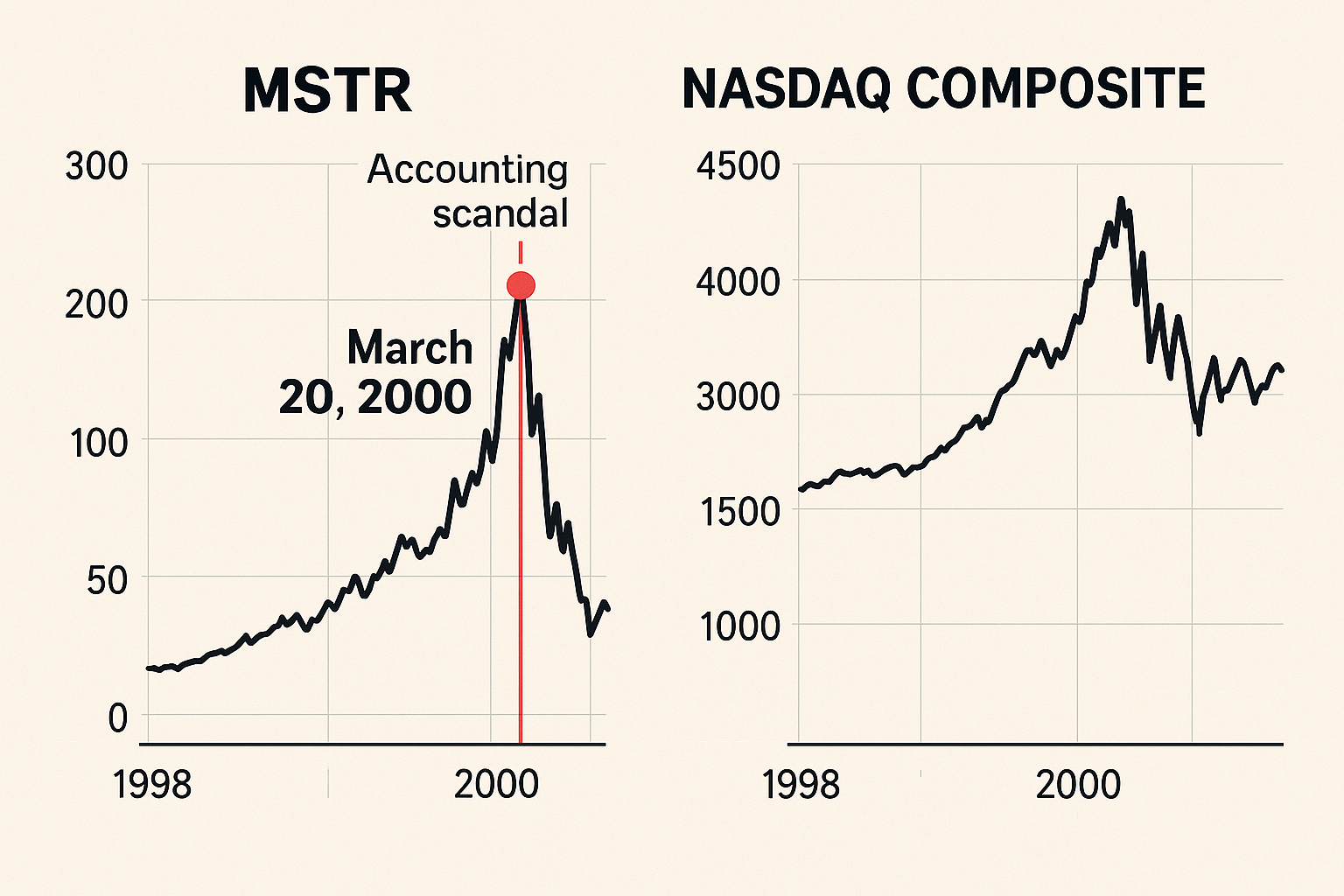

MicroStrategy was founded in 1989 as a business intelligence software company. It went public in June 1998 and, like many tech companies of the era, saw its stock skyrocket during the late-90s dot-com bubble. By early 2000, MSTR shares traded above $300 as investors chased high-growth tech names. However, MicroStrategy’s fortunes reversed abruptly in March 2000 when the company announced it would restate its financials due to accounting irregularities. The SEC later charged MicroStrategy and Saylor with civil accounting fraud for prematurely recognizing revenue in 1997-1999. The scandal caused MSTR’s stock to crash over 60% in a single day (from about $333 to $120), helping burst the dot-com bubble. Saylor settled with regulators, paying millions in penalties, and the stock languished at single-digit prices in the early 2000s. This early history of hubris established a pattern: an ambitious visionary pushing aggressive strategies that eventually hit a wall.

For the next two decades, MicroStrategy remained a niche software firm. Its core business – analytics and enterprise intelligence software – delivered modest revenues and often struggled to grow. By 2019, the stock traded around $120, with little fanfare on Wall Street. Everything changed in 2020. Amid the COVID-19 pandemic and global monetary stimulus, Saylor became convinced that Bitcoin was the answer to currency debasement. In August 2020, MicroStrategy announced its first Bitcoin purchase (21,454 BTC for $250 million), effectively adopting Bitcoin as its primary treasury reserve asset. This was unprecedented – MicroStrategy was the first U.S. public company to deploy its corporate cash into Bitcoin on such a scale. The company didn’t stop there: it continued buying Bitcoin aggressively through 2021 and beyond, using both existing cash and funds raised from debt and equity issuance.

The impact on MSTR’s stock price was immediate and dramatic. Between October 2020 and February 2021, MicroStrategy’s share price rocketed from around $150 to over $1,000 – an almost 7x increase in just a few months. This mirrored Bitcoin’s own rally (from ~$11k to over $50k in the same period) but with an even greater magnitude. In the subsequent Bitcoin bull run toward late 2021, MSTR again surged (from roughly $160 in mid-2020 to nearly $900 by November 2021 when BTC hit $69k). Essentially, MicroStrategy’s pivot turned its stock into a high-beta Bitcoin tracker. It also attracted a new breed of investor to MSTR – crypto enthusiasts and momentum traders – who likely had never glanced at the company’s earnings reports but were eager to ride the Bitcoin wave through a stock.

MicroStrategy’s transformation from a staid software firm to a Bitcoin proxy was cemented by mid-2021. By then, the company had even issued corporate bonds specifically to buy more Bitcoin. In a symbolic move, Michael Saylor relinquished his CEO title in 2022 to focus exclusively on the company’s Bitcoin strategy as Executive Chairman (handing the CEO reins to Phong Le). By early 2025, the firm even rebranded itself as “Strategy, Inc.”, underscoring that it’s no longer about “MicroStrategy” software – it’s about the macro strategy of holding Bitcoin. MSTR’s corporate identity now revolves around Bitcoin so completely that the health of its software business barely registers in the stock’s valuation or narrative.

Michael Saylor: The Cult of Personality Fueling the Hype

To understand the excitement around MSTR, one must understand Michael Saylor, the company’s co-founder and public face. Saylor is a charismatic and controversial figure whose personal brand is inseparable from MicroStrategy’s stock performance. In the late 1990s, he was a young, bold tech CEO – even briefly a billionaire on paper before the 2000 crash wiped out over $6 billion of his wealth. He garnered a reputation for hubris, especially after the 2000 accounting scandal. But two decades later, Saylor managed one of the most spectacular second acts in corporate history by reinventing himself as a Bitcoin evangelist.

Starting in 2020, Saylor became one of the loudest cheerleaders for Bitcoin, espousing a philosophy that borders on the religious. He famously describes Bitcoin in grandiose terms – as “digital energy”, “thermodynamically sound money”, and “a swarm of cyber hornets serving the goddess of wisdom.” This colorful, meme-worthy language has helped him amass a cult-like following on social media. By 2021, Saylor was a fixture on Twitter (now X), preaching Bitcoin maximalism daily to an audience of millions. He even hosted high-profile webinars like “Bitcoin for Corporations” to encourage other companies to convert their treasuries into Bitcoin (few have followed to the extent MSTR did, but the events further boosted his clout).

Saylor’s communication style is a key part of why everyone is excited about MSTR. He mixes technical jargon with philosophical zeal, which, as one observer noted, is “just technical enough to fool the moderately sophisticated.” In other words, he can appeal to both hardcore crypto nerds and lay investors with sweeping claims that Bitcoin fixes everything. For many Bitcoin believers, Saylor became a hero – a visionary CEO risking his company to champion a greater cause. This savior narrative provides powerful cover for MicroStrategy’s lackluster fundamentals; investors aren’t just buying a stock, they’re “joining a movement” led by Saylor. This dynamic resembles the meme stock phenomenon (think GameStop or AMC) where a passionate online community can, for a time, decouple a stock’s price from reality. Indeed, some MicroStrategy shareholders openly say they’ll never sell because holding MSTR is a statement of faith in Bitcoin’s future – even if it means enduring huge volatility or paper losses. This “cause over profit” mentality is sometimes called financial nihilism, and Saylor has tapped into it masterfully.

It’s worth noting that Saylor’s conversion to Bitcoin evangelism was extremely well-timed. In December 2013, he had tweeted that Bitcoin’s days were numbered and it would share the fate of online gambling – a dismissive stance. For the next seven years, he rarely mentioned Bitcoin at all. Then, in August 2020, right as MicroStrategy made its first big Bitcoin buy, Saylor flipped overnight into the most fervent Bitcoin bull imaginable. The coincidence is hard to ignore: his philosophical awakening conveniently aligned with a massive financial bet. Critics argue that Saylor’s sudden U-turn was less epiphany and more opportunism – he needed a bold new narrative for a stagnating company, and Bitcoin provided the perfect storyline. Regardless of motive, the pivot paid off in the short run: it ignited MSTR’s stock and elevated Saylor to rockstar status in the crypto world.

However, Saylor’s leadership has not been without controversy beyond Bitcoin. In 2022, the District of Columbia sued him for tax fraud, alleging he had evaded paying over $25 million in income taxes by falsely claiming residency in Florida while actually living in D.C. for years. In June 2024, Saylor and MicroStrategy settled the case for $40 million (with Saylor reportedly paying the entire amount). This came on the heels of his earlier SEC settlement in 2000. Such episodes call into question Saylor’s judgment and governance ethics, even as fans brush them off. For traders, it’s a reminder that betting on MSTR is not just a bet on Bitcoin, but a bet on Saylor himself – a polarizing figure who inspires both devotion and skepticism.

The cult of personality he’s built is a double-edged sword: it drives enthusiasm (and thus the stock’s premium), but it also means MSTR’s fate is heavily tied to the credibility and behavior of one man.

Why Investors Are Excited About MSTR

MicroStrategy’s stock has garnered outsized attention and excitement primarily because it offers something unique: a leveraged, publicly-traded play on Bitcoin. For a time, MSTR was one of the few ways institutions (or certain retail accounts) could gain Bitcoin exposure through traditional markets. Before the advent of U.S. spot Bitcoin ETFs (more on that shortly), if a fund or investor couldn’t directly hold crypto, buying MSTR was a proxy strategy. Each share of MSTR effectively represents a bundle of Bitcoin (plus a struggling software business, plus some debt – the nuances of which many chose to overlook). Here are the key reasons investors have been high on MSTR:

- Amplified Bitcoin Gains: Thanks to its use of debt and new equity to buy Bitcoin, MicroStrategy is leveraged to Bitcoin’s price. This means in a roaring crypto bull market, MSTR’s stock can outperform Bitcoin itself. We saw this in early 2021 and again in early 2024. For example, in the first quarter of 2024, Bitcoin’s price jumped about 60%, but MSTR stock soared roughly 180% in the same period – triple the return. Traders seeking torqued upside have viewed MSTR as a way to potentially get a Bitcoin-like return plus extra juice. In late 2020 through 2021, this certainly played out: MSTR rose thousands of percent off its 2020 lows, far more than an index or most tech stocks, rewarding those who got in early on Saylor’s bet.

- Bitcoin Hype and Narrative: MicroStrategy rode the coattails of Bitcoin’s cultural momentum. As Bitcoin became a household name in 2020-2021, MSTR became a story stock tied to that excitement. The media began referring to MicroStrategy as “the Bitcoin company” or even Saylor’s “Bitcoin ETF.” This narrative momentum meant that positive news in the crypto space (such as Elon Musk’s comments or other companies dabbling in Bitcoin) often spilled over to boost MSTR shares. For true believers in crypto, owning MSTR felt like being part of the digital gold rush led by a charismatic general. Every new Bitcoin purchase announcement by MicroStrategy (and there have been many) acted like a hype catalyst for the stock price, signaling to the market that Saylor was doubling down and that MSTR was the corporate champion of Bitcoin.

- First-Mover Advantage and Brand: MicroStrategy’s bold move gave it a first-mover advantage. It quickly amassed one of the largest Bitcoin treasuries of any public company. By mid-2024, MicroStrategy held over 220,000 BTC (which, at that time, was worth roughly $13–14 billion). Just the sheer size of its holdings – and Saylor’s vocal promotion of them – bestowed gravitas. MSTR became nearly synonymous with “Bitcoin trade” on the stock market. This brand identity also meant that in periods of crypto enthusiasm, MSTR would often be bid up by traders even more aggressively than Bitcoin itself, due to FOMO (fear of missing out) and the relative scarcity of such pure-play crypto stocks.

- Momentum and Technical Traders: The wild price swings and high volumes in MSTR attracted short-term traders and algorithmic funds as well. The stock became known for its high volatility and momentum-driven moves. Once a trend gets going in MSTR (up or down), it often overshoots because many traders pile in, amplifying the move. This volatility – while risky – is exciting for those who thrive on fast markets. During the meme stock craze of 2021, for instance, MicroStrategy occasionally featured in chatter alongside the likes of GameStop, as a candidate for big intraday swings and even short squeezes. Speaking of shorts, MSTR has often had a significant short interest from skeptics, which ironically can add to upside fireworks when those shorts get squeezed and forced to buy back shares. In other words, volatility begets more volatility, making MSTR a thrill ride for market speculators.

- Hope for a “Bitcoin Jackpot”: Some investors view MSTR not just as a trading vehicle but as a potential lottery ticket. The thinking goes: if Bitcoin eventually soars to extremely high levels (say $500k or $1 million per coin in some future world), then MicroStrategy’s trove of BTC would be astronomically valuable, and the stock could go up an order of magnitude or more. In this ultra-bull scenario, perhaps the complexities of debt and dilution won’t matter – the common shareholders would still see massive gains. This lottery-ticket mindset has kept some money flowing into MSTR, as a way to bet on a moonshot outcome where Saylor’s gamble pays off spectacularly.

It’s important to note that all these sources of excitement rely on sentiment and forward-looking optimism. They downplay traditional fundamentals in favor of narrative and macro factors (Bitcoin price direction, Fed policy, etc.). That’s why MicroStrategy can be described as a speculative vehicle more than a conventional investment. The stock’s fortune rises and falls almost entirely with Bitcoin sentiment; for instance, when Bitcoin entered a bear market in 2022, MSTR plunged from around $800 at its peak down to nearly $150 at its trough – an over 80% collapse, mirroring Bitcoin’s drawdown and then some. The excitement around MSTR is thus a double-edged sword: it propels the stock higher in good times, but it can evaporate quickly in bad times, leaving a long way to fall.

The “Intelligent Leverage” Strategy – A Closer Look

MicroStrategy’s management frequently touts its “Bitcoin per share” growth and the use of “intelligent leverage” as a genius strategy. Understanding this mechanism is critical for traders, because it reveals how new investors fund the gains of existing investors, and why this approach cannot continue indefinitely. Let’s break down how MicroStrategy finances its Bitcoin binge:

- Equity Dilution: MicroStrategy has issued a large amount of new stock over the past few years. Each time the stock price surges (often thanks to Bitcoin’s rise and the speculative premium on MSTR), the company seizes the opportunity to sell additional shares to the public. For example, in 2020–2021, MSTR conducted multiple at-the-market stock offerings, raising capital that went straight into buying Bitcoin. Similarly, in 2023–2024, the company created new classes of preferred stock (with tickers like $MSTRD, $MSTRK, etc.) and sold those to raise cash for more Bitcoin. The result is a rapidly rising share count. (In fact, by 2025 the share count had ballooned so much that MicroStrategy’s market capitalization reached over $100 billion at one point, even though the underlying asset value was much lower – a sign of heavy dilution).

- Convertible Debt: In addition to selling stock, MicroStrategy borrowed billions of dollars via convertible senior notes. These are bonds that pay little to no cash interest (some were issued with 0% coupon!) but give bondholders the right to convert into MSTR shares at a high premium later. Saylor cleverly tapped eager debt markets in 2020-2021, raising funds at low interest costs on the premise that lenders could share in upside if the stock soared. The proceeds from these bond issuances were, of course, used to buy Bitcoin. Convertible debt allowed MicroStrategy to leverage up without immediately diluting shareholders – the dilution is delayed until conversion (and if the stock never reaches the conversion price, the company would owe cash repayment instead). It was a gamble that the stock would keep climbing alongside Bitcoin so that these debts could eventually be rolled over or converted into equity with less pain.

- Straight Debt and Loans: The company even took out a secured loan at one point, using some of its Bitcoin holdings as collateral (akin to how an individual might take a mortgage against a house). This introduced the risk of margin calls – if Bitcoin’s price fell too much, the lender could require more collateral or force liquidation of some Bitcoin. MicroStrategy narrowly avoided disaster during the 2022 crypto crash; Saylor disclosed that if Bitcoin fell below roughly $21,000, the company would need to add collateral. Bitcoin did flirt with the low $20k range in June 2022, but then rebounded, sparing MSTR from that margin call scenario.

The “intelligent leverage” that Saylor espouses is essentially this cycle: issue expensive stock or convertibles at high prices → buy more Bitcoin → boast that “Bitcoin per share” has increased → repeat. Superficially, it sounds smart: as long as the company issues new shares at a price well above the net asset value (NAV) of the Bitcoin those shares represent, existing shareholders gain a greater share of Bitcoin ownership per share. MicroStrategy’s presentations love to highlight that their Bitcoin holdings have grown faster (in percentage terms) than their shares outstanding, leading to this accretion.

However, this strategy is a mathematical mirage. Let’s use a simplified example to illustrate the fallacy:

Example: Imagine MicroStrategy has 1,000 shares outstanding and owns 10 Bitcoin. That’s 0.01 BTC per share. Now, the stock is trading at a hefty premium above the value of its 10 BTC – perhaps because investors expect future growth. Suppose MSTR issues 200 new shares at the market price, and with that money it buys 2 more Bitcoin. Now the company has 12 BTC and 1,200 shares. Lo and behold, it has 0.01 BTC per share again (12/1200 = 0.01). In this simple case, Bitcoin per share stayed flat. If instead they managed to issue those shares at an even higher premium and buy, say, 3 BTC with the proceeds, then we’d have 13 BTC over 1,200 shares = ~0.0108 BTC per share. An 8% increase in BTC per share – “accretive,” as Saylor would crow.

But who paid for that increase? The new shareholders entirely funded the purchase of those additional Bitcoins, yet their ownership claim on the new bitcoins is diluted across all shareholders, including the old ones. In effect, value was transferred from the new investors to the earlier investors. The illusion of intelligent leverage is that everyone benefits from the rising Bitcoin per share metric – but in truth, the pie grew only because new money came in, and the division of the pie was skewed to favor those who were already at the table.

This resembles a Ponzi-like dynamic (though not a classic Ponzi scheme since there’s a real asset – Bitcoin – and trades occur on an open market). The model requires a continuous influx of ever-larger amounts of new capital to sustain the growth in assets per share. As one analysis put it, a little dilution over a long enough time horizon becomes infinite dilution – and the value of each share approaches zero in the limit. If at any point the market’s appetite to buy new MSTR shares at a premium dries up, the music stops. MicroStrategy would then be unable to keep buying more Bitcoin without reducing the coveted Bitcoin-per-share, and it could no longer easily fund its operations or debt service. In essence, the “infinite money glitch” would break.

It’s crucial for traders to grasp this: MicroStrategy’s Bitcoin accumulation is being funded by dilution and debt. Early shareholders have indeed seen their Bitcoin per share rise significantly from 2020 levels, but that came at the direct expense of those who bought in later at much higher prices. If you buy MSTR today, you are effectively paying a high premium for a small slice of the existing Bitcoin pile, and you are subsidizing the prior shareholders’ stake. It’s only worth it if you believe someone after you will pay even more for an even smaller slice – a classic case of speculative fervor. This is why many skeptics argue MicroStrategy’s strategy shares DNA with a pyramid scheme – it’s sustainable only as long as the stock price stays irrationally high and new buyers keep coming.

A Precarious Capital Structure: Debt, Preferred Stock, and Dilution

MicroStrategy’s balance sheet is unlike that of any typical software company – or any typical company at all. To finance its Bitcoin purchases, MSTR has accumulated a tower of liabilities and complex securities that sit senior to the common stock. This capital structure is crucial when evaluating risk: it determines who gets paid and who gets wiped out if things go south.

Here’s a breakdown of what’s stacked on top of the common equity in MicroStrategy’s capital stack as of 2025:

- Convertible Senior Notes (~$2.4 billion): These are bonds that come due in 2027, 2028, 2030, and 2032 (from various issuances over 2020-2021). They carry conversion prices ranging from a few hundred dollars to over $1000 per share. Until maturity or conversion, they are debt that must be repaid (or refinanced) and sit ahead of shareholders in priority. Notably, some of these were issued at 0%–0.75% interest, which was incredibly cheap money. However, cheap or not, the principal (billions of dollars) eventually has to be dealt with.

- Secured Term Loan (~$200 million): In 2022, MicroStrategy’s subsidiary took a loan from Silvergate Bank (now repaid early, but it demonstrated the willingness to mortgage Bitcoin holdings). This loan was relatively small but carried the risk of margin calls if Bitcoin’s price fell below a threshold. It highlighted that MicroStrategy was not shy about leveraging its Bitcoin collateral for cash.

- Perpetual Preferred Stock (~$5–6 billion issued): Starting in late 2023, MicroStrategy began issuing new classes of preferred equity (with tickers like MSTR-K, MSTR-D, MSTR-F, etc., often nicknamed “STRK”, “STRD”, etc.). These are essentially high-yield dividend stocks that function like bonds in disguise. For instance, one series carries an 8% annual dividend and another a 10% dividend, to be paid in cash. “Perpetual” means they have no maturity date – the company is on the hook to pay those dividends indefinitely, or until it redeems the shares. The proceeds from selling these preferred shares were used to buy more Bitcoin (of course). Importantly, these preferreds have a liquidation preference over common stock, usually $1000 or $100 per share of preferred, meaning in any bankruptcy or liquidation, they must be paid their full principal + any unpaid dividends before common shareholders get a penny.

- Additional Equity Offerings: Even beyond the preferreds, MicroStrategy continued issuing common stock via at-the-market programs. The share count exploded from roughly 9 million in 2020 to over 300 million by 2025 (split-adjusted or post-rebrand basis). This massive dilution provided cash for Bitcoin and also cash to service debts and pay those preferred dividends. The company explicitly stated its policy to use any available cash flows and proceeds from financings to acquire Bitcoin – effectively, it has been consuming external capital nonstop rather than generating internal profits.

The result of all this is a highly fragile financial structure. MicroStrategy now owes large fixed obligations each year (interest on debt, and hundreds of millions in preferred dividends). Yet, its core business doesn’t produce anywhere near enough cash to cover these costs (more on the weak core business next). Therefore, the only way MSTR can meet these obligations is by continually issuing and selling more common stock – diluting shareholders further. This creates a vicious cycle: to pay its growing bills, the company must dilute the very shareholders who are supposed to eventually profit. It’s like trying to keep a leaky boat afloat by borrowing water from another leaky boat; it works until both boats inevitably sink.

One must also consider the timeline risk.

MicroStrategy faces a debt refinancing wall in the late 2020s and early 2030s when those convertible bonds mature. Between 2027 and 2032, billions in principal will come due. How can the company handle that? There are limited options, each unappealing:

- Option A: Sell Bitcoin to pay debt. This would directly undermine the company’s raison d’être as a Bitcoin HODLer and likely crash the stock (and possibly the Bitcoin market if it’s a lot at once). It’s a last resort that Saylor has indicated he wants to avoid at all costs – Bitcoin is the crown jewel and selling it would be admitting defeat.

- Option B: Issue even more equity to pay off debt. This is only viable if the stock remains sky-high. If the MSTR premium collapsed by then, issuing, say, $3B of new stock could require enormous dilution. If the stock is low, it might not even be feasible (or would push the price down further). Essentially, this is kicking the can with dilution.

- Option C: Refinance by borrowing again (new debt). This depends on credit markets and the company’s perceived risk at that time. If Bitcoin is booming and MSTR’s assets are way up, perhaps they could borrow anew (though interest rates might be higher). But if Bitcoin is down or the market’s wary, who would lend more billions to a company that burns cash and has barely any non-Bitcoin assets? The cost could be prohibitive, or lenders might demand collateral (i.e. pledging more of the Bitcoin, which circles back to Option A risk).

If none of those options are available, Option D is bankruptcy or restructuring – where debt holders and preferred shareholders would take control of the assets (the Bitcoin stash) and the common shareholders likely get wiped out. It’s a grim scenario, but one that cannot be dismissed given the mathematical inevitability of those obligations coming due. MSTR bulls often assume “Bitcoin will be so high by then it won’t matter,” and indeed, if Bitcoin went to, say, $1 million, MicroStrategy’s ~200-600k BTC (depending on future buys) would be worth hundreds of billions, easily covering debts. But that’s a speculation on top of a speculation. Traders must ask: what if Bitcoin isn’t astronomically higher by 2027? The entire house of cards could collapse.

In summary, MicroStrategy’s capital structure is engineered to transfer risk and value away from common shareholders over time. The debt holders and preferred shareholders have comparatively safer positions – they either get their interest/dividends or eventually claim the Bitcoin assets before common stock gets anything. The common stock is effectively the residual claim on whatever is left after paying all the senior claims. And with each passing quarter that involves issuing new preferred or debt, the overhang of senior claims grows, while the slice left for common shrinks. This is why some analysts say owning MSTR common stock is like holding a “deeply out-of-the-money call option” on Bitcoin – you’re last in line to benefit from Bitcoin’s value, because so many layers of obligations sit on top of you.

A Dying Core Business (The Elephant in the Room)

Lost amidst the Bitcoin hoopla is the uncomfortable fact that MicroStrategy’s original business – selling enterprise analytics and software services – is in decline. The company still generates revenue from software licenses, subscriptions, and support, but those numbers have been shrinking or barely holding steady, even as Bitcoin dominated earnings calls. Here’s the rundown on MicroStrategy’s software segment:

- Stagnant/Declining Revenue: In 2024, MicroStrategy’s total software revenues were around $460 million, down from about $500 million a couple years prior. Year after year, the legacy business has struggled to grow. The firm’s on-premise software licensing revenues have dropped sharply as the industry moves to cloud-based subscriptions. MicroStrategy has tried to pivot to a cloud subscription model, and indeed its subscription revenue is growing (for example, subscription services were up over 30% in 2024). But that growth isn’t enough to offset declines in large one-time license deals and maintenance fees. The net result: total revenue is drifting downward, suggesting MicroStrategy is slowly losing relevance in a competitive software market (competing against giants like Microsoft, Tableau/Salesforce, etc.).

- Thin (or Negative) Profitability: Even when ignoring the wild Bitcoin-related accounting gains/losses, the core business isn’t very profitable. Software companies typically have high gross margins, and MSTR’s software gross margin is decent – but their operating expenses (R&D, sales, G&A) eat up nearly all gross profit. In many recent years, if you strip out the Bitcoin asset fluctuations, MicroStrategy’s operating business either barely breaks even or runs at a loss. This means the company’s operations cannot fund its debt interest or preferred dividends. For instance, servicing $5+ billion of preferred equity at ~8-10% would require $400–500 million in cash annually – the software business doesn’t generate anywhere close to that in free cash flow. This cash flow shortfall underscores that the Bitcoin strategy has made MicroStrategy a capital-consuming company rather than a capital-producing one.

- Little Reinvestment: One might wonder, is MicroStrategy at least investing in improving its software products, to have a plan B if Bitcoin falters? The evidence suggests not in any significant way. R&D spending has been modest and relatively flat. The company’s focus (and capital allocation) is clearly on Bitcoin, not on expanding the software side. In fact, MicroStrategy has not made any notable software acquisitions or expansions in years – a stark contrast to the cash-rich tech firms that reinvest in growth. Saylor himself has implied that traditional business intelligence is a mature, slow-growth field, and that Bitcoin is the “higher upside” play. So the core business is effectively being treated as a cash cow to be milked (for whatever small cash it produces) and otherwise left to slowly wither.

Why does this matter to traders? Because it tells us that MicroStrategy-as-a-company has no fundamental safety net. If Bitcoin’s price were to stagnate or decline for an extended period, there is no strong underlying earnings engine to support the stock or even sustain the corporate obligations. In a conventional company, if the stock fell a lot, value investors might step in if the company had stable earnings or assets. In MSTR’s case, the only significant assets are Bitcoin, and those are committed to an extreme strategy. The software business likely wouldn’t even fetch much in a sale (given its shrinking state and the competitive environment).

In short, MicroStrategy is not a “bitcoin plus a business” story; it’s essentially just the bitcoin. The legacy business exists on paper but has minimal influence on the valuation. Management’s own actions confirm this: every spare dollar (and many borrowed or raised dollars) goes into Bitcoin, not into rejuvenating the software operations. Traders should therefore analyze MSTR as they would a closed-end fund or ETF holding Bitcoin with a high expense ratio and leverage, rather than as a tech stock. This perspective will help in assessing its true risks and pricing inefficiencies.

SWOT Analysis of MicroStrategy (MSTR)

To summarize the company’s position, let’s lay out a brief SWOT analysis – Strengths, Weaknesses, Opportunities, Threats – from the perspective of a MicroStrategy observer or investor:

- Strengths:

- Pioneer Advantage: MicroStrategy was the first mover in adopting a Bitcoin treasury strategy at this scale, giving it a high profile in the crypto investment community.

- Massive Bitcoin Holdings: With hundreds of thousands of bitcoins accumulated, MSTR is effectively a Bitcoin whale. This scale means if Bitcoin’s price soars, the absolute dollar value increase of its holdings is enormous.

- Brand & Leadership: Michael Saylor’s high-profile advocacy has made MicroStrategy an authority (or at least a poster-child) for institutional Bitcoin adoption. The company’s name is almost synonymous with bullish Bitcoin conviction, attracting investors who want alignment with that vision.

- Weaknesses:

- Overleveraged & Dilutive Model: The company’s strategy relies on heavy leverage and dilution, which long-term erodes the value for common shareholders. The capital structure is straining under debt and high-cost preferred equity.

- Unprofitable Core Business: The legacy software segment is shrinking and barely profitable, providing little support to the overall enterprise. Essentially, MSTR has no diversified income – it’s all one bet.

- Concentration Risk: MicroStrategy is extraordinarily concentrated in a single volatile asset (Bitcoin). There’s virtually no diversification – a far cry from prudent corporate treasury management. This makes the stock riskier than even many crypto companies.

- Opportunities:

- Bitcoin Bull Market: The obvious opportunity is if Bitcoin enters a new multi-year bull market, significantly increasing in price. This could boost MSTR’s asset value and may reignite a speculative premium. In a scenario where BTC, say, doubles or triples from current levels, MSTR stock could skyrocket (perhaps even outpacing BTC again in the short run).

- Market Adoption & Integration: As Bitcoin and crypto become more mainstream (e.g., through ETFs, regulatory clarity, Lightning Network adoption, etc.), MicroStrategy might find new ways to leverage its holdings. There’s been talk of Lightning applications or other Bitcoin-related business integrations (though nothing concrete yet). If MSTR can monetize its Bitcoin expertise or holdings beyond just price appreciation – for instance, through partnerships or offering custodial services – that could add value.

- Short Squeeze Potential: With many skeptics around, MSTR often has a significant short interest. At times, if positive news hits (like a big Bitcoin rally or a surprise move from Saylor), a cascading short squeeze could temporarily send shares much higher, offering trading opportunities.

- Threats:

- Bitcoin Price Collapse: The biggest threat is straightforward – if Bitcoin’s price crashes or languishes, MicroStrategy’s stock will almost certainly plummet. A severe crypto winter could even jeopardize the company’s solvency if it coincides with debt maturities or collateral calls.

- Collapse of Premium/Competition from ETFs: MicroStrategy has long traded at a premium to the value of its Bitcoin holdings. With the introduction of spot Bitcoin ETFs (which began launching in 2024), investors now have cleaner, cheaper ways to get Bitcoin exposure. If capital shifts from MSTR to those ETFs, the stock’s premium could evaporate, causing MSTR to underperform or drop even if Bitcoin is flat. Competition from more efficient vehicles is a serious threat to MSTR’s valuation.

- Regulatory or Governance Risks: MSTR operates in a grey area – it’s essentially an investment vehicle but not regulated as one. If regulators took issue with its unconventional structure or if any new laws affect corporate crypto holdings, that could hurt. Additionally, any further legal troubles for Saylor or governance missteps could sour investor sentiment quickly (for example, another lawsuit or even internal conflict could break the aura of the infallible leader).

- Refinancing/Liquidity Crunch: As discussed, the debt wall in a few years is a looming threat. If market conditions are unfavorable when MicroStrategy needs to refinance debt or raise more cash, it could lead to distress. Even before an absolute crunch, the market might start pricing in this risk well in advance, pressuring the stock.

In a nutshell, MicroStrategy’s strengths and opportunities are almost entirely tied to Bitcoin’s upside, whereas its weaknesses and threats stem from structural financial issues and Bitcoin’s potential downside. With that landscape in mind, how should one approach trading MSTR? Let’s turn to timing and strategy for buying or selling this rollercoaster of a stock.

Trading MSTR: Technical Trends and Timing Strategies

Trading MicroStrategy stock successfully requires understanding its unusual behavior and what drives its price movements. Here are key considerations and patterns that traders have observed:

- High Correlation with Bitcoin: It should come as no surprise that MSTR’s chart closely follows Bitcoin’s chart. Over the past few years, the correlation between MSTR and BTC has often been in the 0.7–0.9 range (with 1.0 being perfect correlation). In practice, this means if Bitcoin has a big move up or down, MSTR is very likely to move in the same direction on that day. Often, MSTR’s moves are magnified – for instance, on a day Bitcoin rises 5%, MSTR might jump 10%. This correlation is so strong that many traders essentially treat MSTR as a Bitcoin trading vehicle. Before the advent of Bitcoin ETFs, some even called MSTR the “de facto Bitcoin ETF” due to this lockstep behavior.

- Even Higher Volatility: While Bitcoin is famously volatile, MSTR often takes it up a notch. The stock’s beta relative to BTC is greater than 1 (meaning it’s more volatile than Bitcoin). This is partly due to leverage (the company has debt – leverage tends to amplify equity volatility) and partly due to the speculative premium dynamics. For example, during the severe crypto downturn of 2022, Bitcoin lost about 75% from peak to trough, whereas MSTR stock crashed roughly 80–85%. In the sharp rebound of early 2021, Bitcoin roughly quintupled, but MSTR stock went up almost tenfold from its 2020 lows. Traders should be prepared for huge swings – double-digit percentage moves in a week are not uncommon for MSTR. Setting appropriate stop losses or position sizing is crucial if you’re trading this name; it’s not for the faint of heart.

- Key Support/Resistance Levels: Technically, MSTR often respects certain psychological or technical levels, many of which correspond to Bitcoin levels translated through the company’s holdings. One rough way traders gauge MSTR’s value is by calculating its Net Asset Value (NAV) – basically the value of its Bitcoin holdings minus debt, divided by shares. When MSTR trades far above its NAV, it’s considered to have a high premium; if it trades near or below NAV, it might be seen as a bargain relative to direct Bitcoin ownership. Chart-wise, this can create support around levels where MSTR’s price equals its BTC per share value. Likewise, when MSTR’s price implies an extremely high Bitcoin price (through the premium), it can form resistance as rational sellers step in. Traditional technical indicators like moving averages (50-day, 200-day) also come into play because many algo traders use them. For instance, during uptrends, MSTR has tended to ride above its 50-day MA, and breaks below that MA sometimes signal momentum cooling. In downtrends, the stock often gets very oversold (its RSI frequently hits extreme lows) which can precede sharp relief bounces.

- Liquidity and Squeezes: MSTR is reasonably liquid for a mid-cap stock, but its float (shares available for trading) can be less than total shares outstanding due to insiders and strategic holders. When short interest builds up, any unexpected positive trigger (say Bitcoin rallying over a weekend or Saylor announcing a new big purchase) can cause a short squeeze. We’ve seen episodes where MSTR jumps 20–30% in a matter of days, blowing past obvious resistance, likely due to shorts covering in a panic. As a trader, if you’re short MSTR, be extremely cautious – the cost of borrowing shares is often high, and the risk of squeeze is ever-present. On the flip side, if you’re long MSTR during a squeeze, it can be very profitable, but always have an exit plan because these spikes can retrace once the squeeze exhausts.

In summary, from a trading perspective, treat MSTR as a leveraged Bitcoin momentum stock. Keep one eye on the Bitcoin chart at all times. Many traders literally set price alerts on BTC or track BTC futures alongside MSTR during market hours – if Bitcoin makes a sudden move, MSTR will likely react swiftly. Technical analysis on MSTR is useful, but it should be coupled with an understanding of Bitcoin’s trend, as well as awareness of any company-specific news (like new financing deals or Saylor share sales).

When to Buy or Sell MSTR – Key Signals and Scenarios

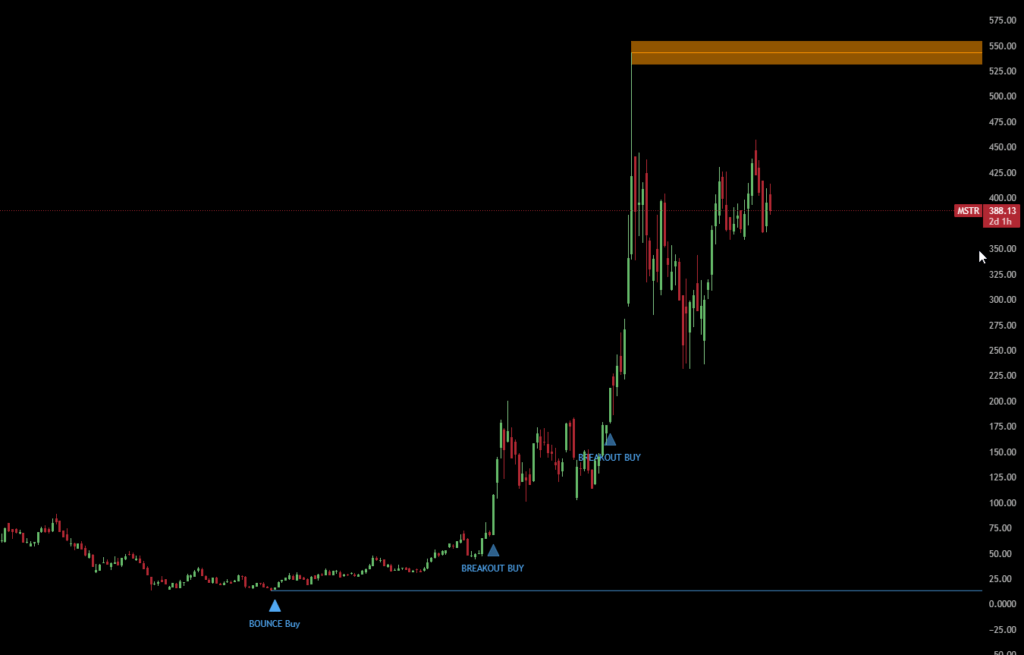

One of the best ways is to use a support and resistance tool we call MagniZone…

Just look at the last three major “BUY” signals on the weekly chart.

Knowing the story and risks is one thing, but timing trades in MSTR is another. Here are some guidelines on when it might make sense to buy or sell (or avoid) MicroStrategy stock, based on market conditions and the analysis above:

Potentially Opportunistic Times to Buy (for a speculative long trade):

- Early in a Bitcoin Upswing: The best time to be long MSTR is typically when Bitcoin has just started a bullish trend or broken out of a basing pattern. MSTR often lags slightly at the very beginning of a Bitcoin move and then catches fire as momentum traders hop on. If you believe Bitcoin has entered a new bull phase (due to macro factors or a halving event, etc.), taking a long position in MSTR can yield outsized gains. The run from late 2020 into early 2021 and the rally in early 2024 were examples where those who bought MSTR early in the Bitcoin up-cycle saw explosive returns. Essentially, MSTR is a high-beta way to ride Bitcoin’s strength.

- When MSTR’s NAV Premium is Low or Negative: Occasionally, market dislocations cause MSTR to trade at or even below the value of its Bitcoin holdings (after accounting for debt). Such moments are rare and often short-lived, but if they occur, it implies you can buy MSTR and get Bitcoin exposure at a discount plus a free call option on any future Saylor maneuvers. For instance, during a period of extreme fear (say Bitcoin crashes very fast), MSTR might overshoot to the downside. A contrarian might step in if MSTR’s market cap falls near the value of its BTC treasury minus liabilities, because historically the stock doesn’t stay at zero-premium for long – speculators usually bid it back up once panic subsides. Buying when the premium is minimal can be a cushion, as you’re essentially paying near fair value for the Bitcoin and not much for the business (which is arguably right, since the business isn’t great). Just be cautious: if you misjudge and Bitcoin keeps falling, “cheap” can get a lot cheaper.

- Ahead of Potential Catalysts (with tight risk management): If you anticipate a positive catalyst like a major Bitcoin ETF approval, a big macro shift (e.g., Fed rate cuts boosting all risk assets), or even something MicroStrategy-specific (rumors of an acquisition or partnership leveraging their Bitcoin), those could be reasons to build a long position. With MSTR, any whiff of extremely good news in Bitcoin world could send it vertical. For example, rumor or news of BlackRock’s iShares Bitcoin Trust gaining traction in early 2024 coincided with a strong rally. If one expects a parabolic phase in Bitcoin (as sometimes happens near blow-off tops), going long MSTR can be a high-octane play – just remember to have an exit strategy for when momentum reverses.

Warning Signs and Times to Sell (or avoid exposure):

- When Bitcoin’s Rally Seems Overextended or Faltering: Since MSTR is basically glued to Bitcoin, if you believe Bitcoin has hit a euphoric peak or is due for a significant correction, it’s probably time to take profits on MSTR or even short it (if you’re aggressive and can handle the risk). Historically, Bitcoin’s blow-off tops (like Dec 2017 or Apr 2021) were followed by huge MSTR declines as well. Watch indicators like Bitcoin’s relative strength index (RSI), funding rates in crypto futures (signaling speculative excess), or simply the news cycle sentiment. If everyone is extraordinarily bullish and price has outrun fundamentals, MSTR will have outrun too. In such scenarios, taking some chips off the table on MSTR is prudent. It’s better to be out a bit early than to round-trip gains, given how fast MSTR can drop.

- If MSTR’s Premium Balloons to Irrational Levels: There have been moments where MSTR’s stock price implied that each Bitcoin on its balance sheet was being valued at double the market price of Bitcoin (a 100%+ NAV premium). For instance, at one point in 2025, the stock traded so high that it reflected an implied Bitcoin price of well over $150,000, even though actual Bitcoin was nowhere near that. Such a situation is often unsustainable; it indicates that speculation has likely overheated. If you’re holding MSTR during a time of sky-high premium, it may be wise to sell or reduce the position, expecting mean reversion. The introduction of Bitcoin ETFs has made it easier to short that premium by arbitrage (long Bitcoin via ETF, short MSTR), which means extreme premiums could get arbitraged away more quickly now. A sensible approach is to monitor MSTR’s market cap vs. the value of its Bitcoin – if the ratio is way above historical norms (historically it floated around 1.3x NAV but if it’s, say, 2x or more), consider that a sell signal.

- Before Major Corporate Events or Deadlines: Keep an eye on MicroStrategy’s financial calendar. Although Bitcoin is the main driver, there are corporate moments that could weigh on the stock. For example, if a large chunk of convertible debt is coming due next year and no plan is announced, the market might start getting nervous well ahead of time. Or if a big preferred dividend payment is upcoming and Bitcoin happened to be down (meaning MSTR might have to sell some shares at a bad time to raise cash), that could pressure the stock. Earnings calls can also be events – not for the earnings themselves (which are usually meaningless due to Bitcoin volatility in accounting), but for any signals from management about their plans (e.g., “We intend to issue more equity” – which they often signal, or any change in strategy). If you sense something concerning might be revealed, you might choose to be on the sidelines. Generally, in the absence of Bitcoin movement, MSTR drifts or sag around earnings if nothing new is shared.

- When Better Alternatives Exist: Now that spot Bitcoin ETFs (like BlackRock’s IBIT, etc.) are available and liquid, one must question: why hold MSTR at all if not for short-term trading? If you simply want Bitcoin exposure, an ETF or even direct BTC is a cleaner and cheaper way. MSTR carries additional baggage – management risk, corporate expenses, and that premium. If you conclude that the market is starting to favor ETFs (which charge maybe 0.5% fee versus MSTR’s effective “fee” which is much higher when you account for the dilution), that might be a structural reason to avoid MSTR. We may see over time that MSTR’s volume declines as ETFs gain assets. If MSTR loses its special status and becomes just an overleveraged fund, its stock could settle at a much lower equilibrium. In practical trading terms: if you notice MSTR’s price lagging Bitcoin during a rally, or its premium steadily eroding, that suggests the market’s preference is shifting – a sign to exit and perhaps rotate into the more efficient vehicles.

For more advanced traders, there is also the strategy of pairs trading MSTR vs. Bitcoin. One popular idea: when MSTR’s premium is very high, short MSTR and go long an equivalent amount of Bitcoin (via futures or ETF) as a hedge. This bet would profit if MSTR underperforms Bitcoin (i.e., the premium narrows). Conversely, if MSTR’s premium is unusually low, one could go long MSTR and short Bitcoin as a play on the premium widening. These tactics require careful execution and risk management, as mismatches in momentum can occur (plus shorting MSTR outright can be risky due to squeezes). But it underscores the point: MSTR’s value relative to Bitcoin is something every trader should watch closely when deciding buy/sell timing.

Conclusion: The MicroStrategy Maze – High Stakes, High Reward, High Risk

MicroStrategy’s journey from software provider to Bitcoin investment vehicle is a fascinating case study of market narrative and speculation. The stock offers an intoxicating mix of elements: a charismatic leader with a grand vision, a tie-in to the cutting-edge world of cryptocurrency, and the adrenaline of high volatility trading. It’s no wonder MSTR has captured the attention of institutional investors, day traders, and crypto enthusiasts alike. In bull markets, MicroStrategy can feel like a money-printing machine for shareholders, as its aggressive strategy pays off with outsized stock gains. Michael Saylor’s “Bitcoin maximalist” crusade has, in the span of a few years, transformed the company’s image and delivered hefty paper profits to those who rode the waves at the right times.

However, beneath the excitement lies a more sobering reality. MicroStrategy is not a fundamentally strong business in the traditional sense. It is, in effect, a leveraged Bitcoin holding company with a built-in negative carry (from debt interest and dividend commitments) and a decaying legacy business. The current stock price reflects sky-high expectations that Bitcoin’s value will keep climbing and that the company can continue to outmaneuver dilution by staying one step ahead with narrative and timing. Any serious disruption to those expectations – be it a prolonged Bitcoin downturn, a loss of faith in Saylor’s leadership, or even a macroeconomic shift that tightens liquidity – could bring the whole edifice crashing down. The “Bitcoin Icarus” analogy fits: MicroStrategy has flown very high by venturing very close to the sun (concentrating everything on Bitcoin). If Bitcoin’s sun keeps shining brighter, MSTR can soar further; if it dims, the wax holding this construct together could melt quickly.

For traders, MicroStrategy can be both lucrative and treacherous. It’s a stock where you could potentially double your money in months or lose half of it just as fast. The key is to stay vigilant: track Bitcoin religiously, monitor MSTR’s premium to NAV, and be aware of the company’s financing maneuvers. MSTR is not a “set it and forget it” kind of investment – it’s a high-stakes speculation that requires active attention.

In the end, whether MicroStrategy’s story ends as a triumphant example of visionary leadership or a cautionary tale of financial engineering run amok remains to be seen. As of now, it stands as a symbol of this era’s market extremes – where a middling software firm can reinvent itself into a $100+ billion Bitcoin giant on paper, where CEOs become internet memes, and where trading a company’s stock feels akin to trading the future of money itself. Investors and traders should approach this maze with eyes wide open. Sometimes the path to potential riches is the same path that leads to ruin if one is not careful. In the world of MicroStrategy and Bitcoin, that fine line is always there – exhilarating, profitable, and perilous all at once.

Thanks for reading!

TSG Team