Weekly Currency Outlook: BOJ Disappoints as Dollar Dominates

The yen headed for a monthly loss after the BOJ disappointed hawks while the Fed dampened December cut expectations. Here's where key assets stand as the dollar continues its dominance.

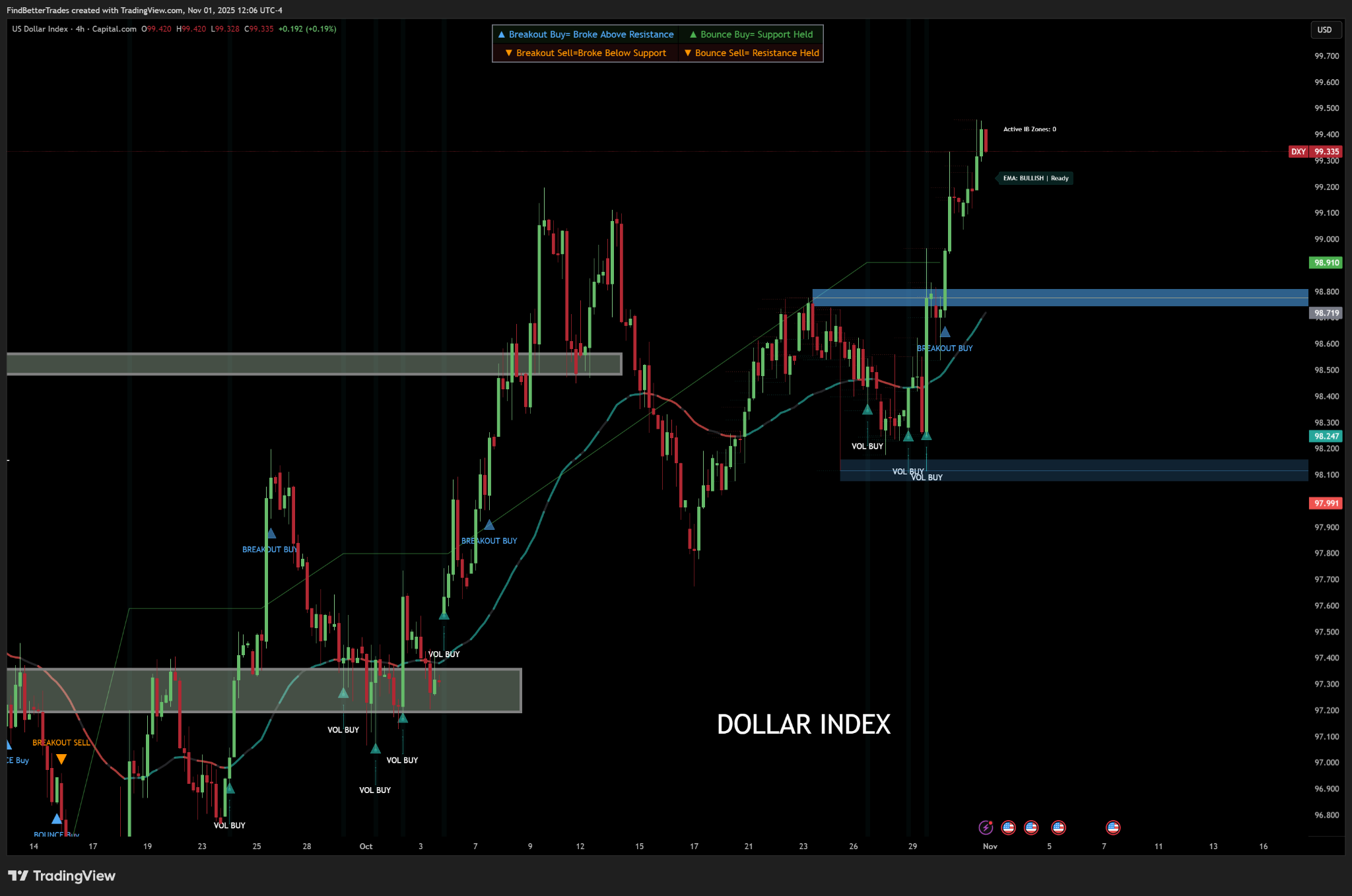

USD: Fed Policy Divide Supports Greenback

The greenback has been boosted by optimism over the economic outlook even as the labor market weakens, with Fed policymakers remaining concerned about inflation. Fed Chair Powell said Wednesday a policy divide within the central bank and lack of government data may put another rate cut out of reach this year.

The Fed cut rates Wednesday as expected, though two policymakers dissented. Governor Stephen Miran called for deeper cuts while Kansas City Fed's Jeffrey Schmid favored no cut. "It sounded like he was just trying to give himself some optionality," notes Noel Dixon at State Street Global Markets.

This divided Fed stance is supporting dollar strength as markets recalibrate expectations for the easing cycle.

EUR: Breaking Below Key Support

The euro dropped 0.37% to $1.1522 after the ECB kept rates unchanged at 2% for the third meeting in a row Thursday, repeating that policy was in a "good place" as economic risks recede. The single currency has fallen 1.8% this month as the dollar gains broadly.

The Euro continues trading to the downside after breaking below the 1.15550 mark the bulls tried to hold. Expectations that price will continue trading below 1.1500 in coming days are highly likely as euro weakness accelerates.

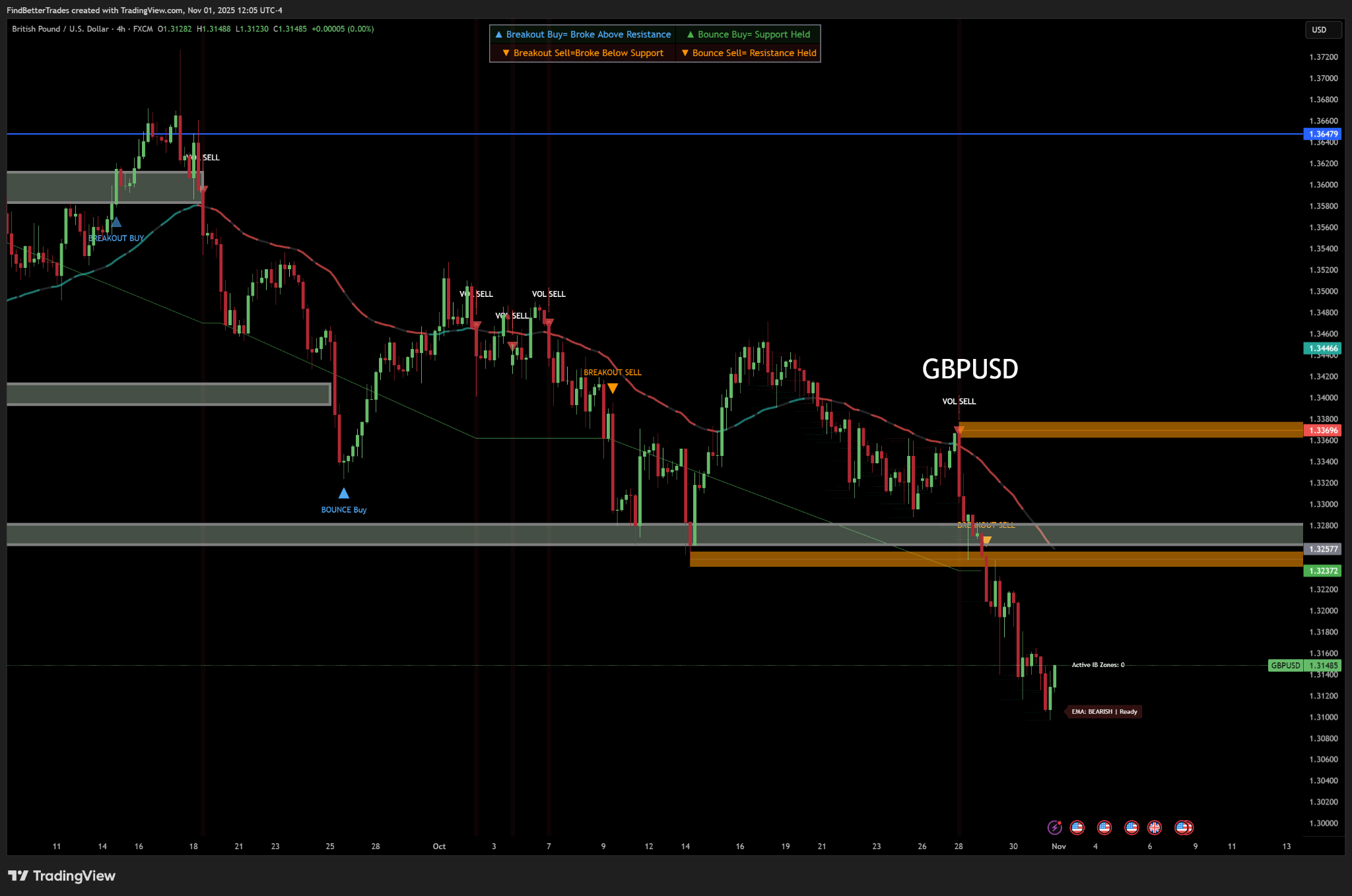

GBP: Lowest Since April

Sterling fell 0.14% to $1.3132 - the lowest since April 14 - as political pressures grew surrounding Finance Minister Rachel Reeves. Against the euro, the pound reached its weakest since May 2023.

The POUND also traded lower into the downside with price clearly aiming for 1.3000 and possibly lower as the dollar continues expanding its influence. The pound is heading for a 2.3% monthly drop, while gilt yields have dropped on concern over what Reeves' November budget might mean for businesses and economic activity.

"While we think GBP sentiment has turned overly bearish, we have long argued against fading the move ahead of the Budget, not to mention the tail risk of the BoE cutting rates next week," warn Bank of America analysts.

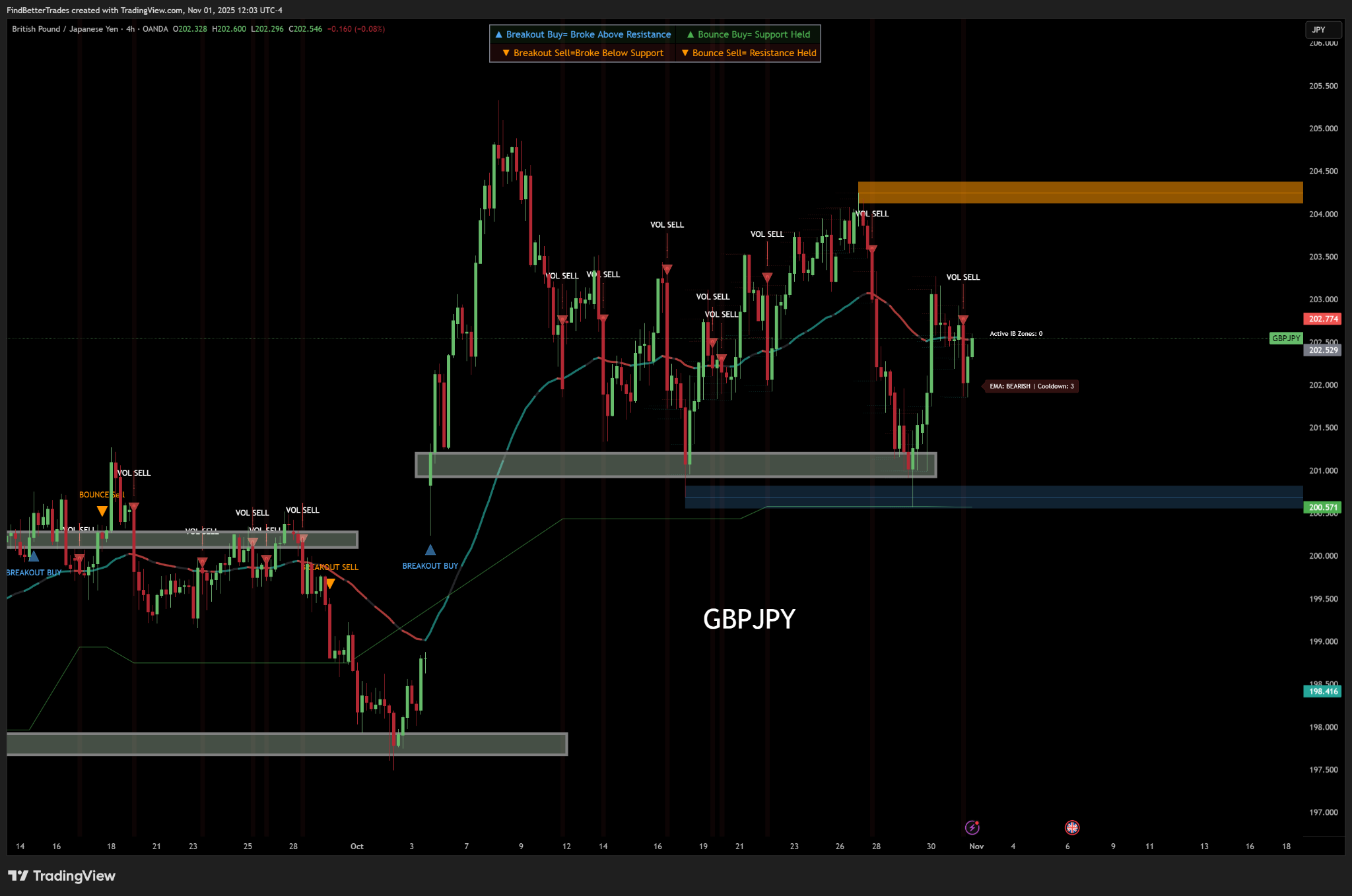

GBPJPY: Range-Bound Struggle

The POUND-YEN traded in mixed bias as it continues ranging between 200-204, with chances of a breakout becoming slimmer. This cross remains stuck as both currencies face their respective challenges - sterling's fiscal concerns and the yen's dovish BOJ stance.

The yen clawed back some losses after Japanese Finance Minister Katayama said the government has been monitoring foreign exchange movements with "a high sense of urgency" as the yen weakens. Core Tokyo inflation accelerated in October and stayed above the BoJ's 2% target.

However, disappointment after BOJ Governor Ueda adopted a less hawkish tone than hoped held the yen in check. The Japanese central bank kept rates on hold at 0.5%.

Dixon remains constructive on the yen long-term: "The BOJ ultimately is still going to have to normalize policy at least to 1%. From a multi-year perspective, wages are definitely higher than they've been… and the fiscal spending is only going to exacerbate that prospect."

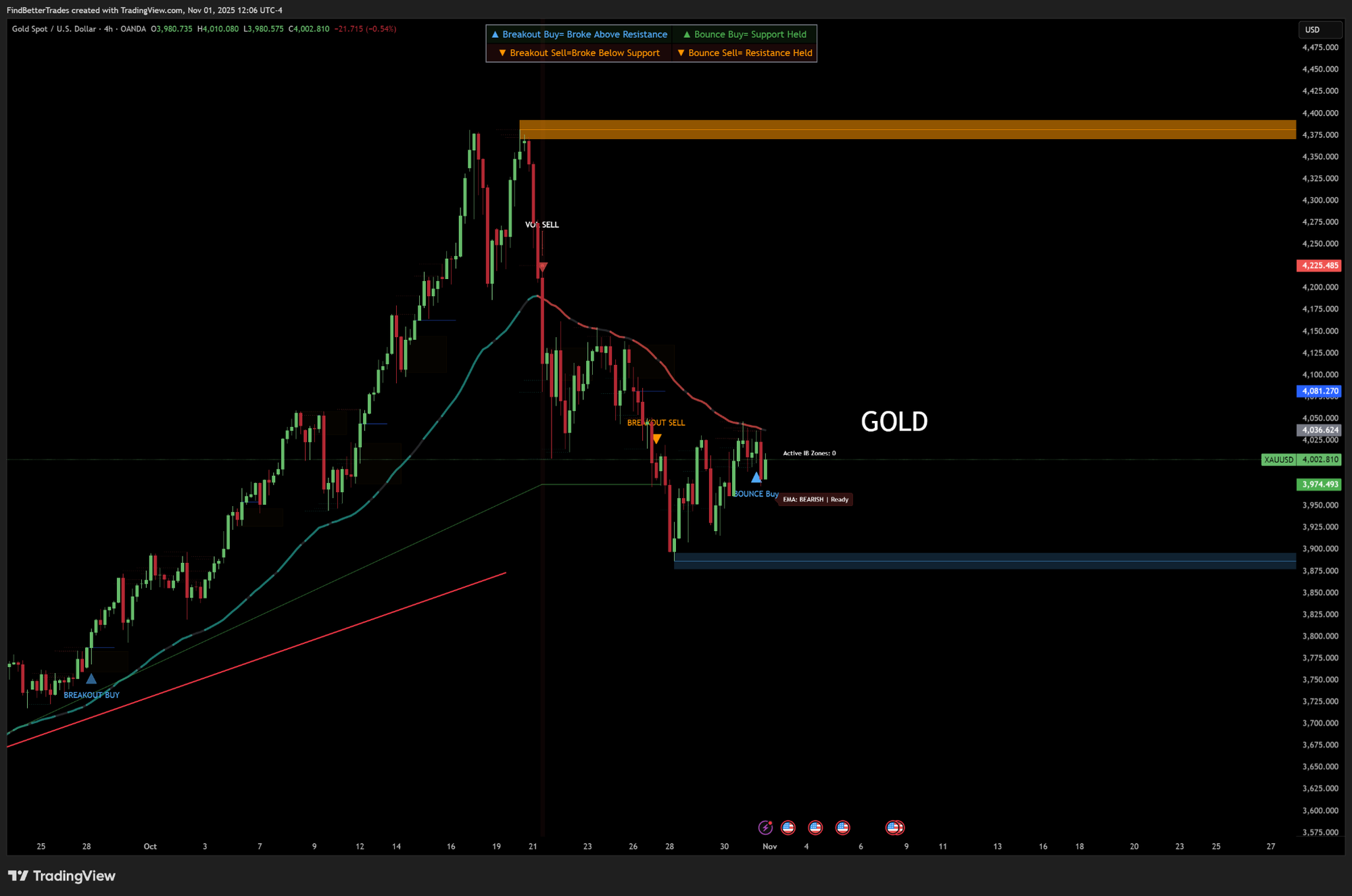

GOLD: Deeper Correction Expected?

Gold stayed trading within the $4,000 range. However, as the dollar continues to dominate, speculations that the correction would get a lot deeper for gold remain to be seen. The precious metal faces headwinds from both dollar strength and reduced Fed easing expectations.

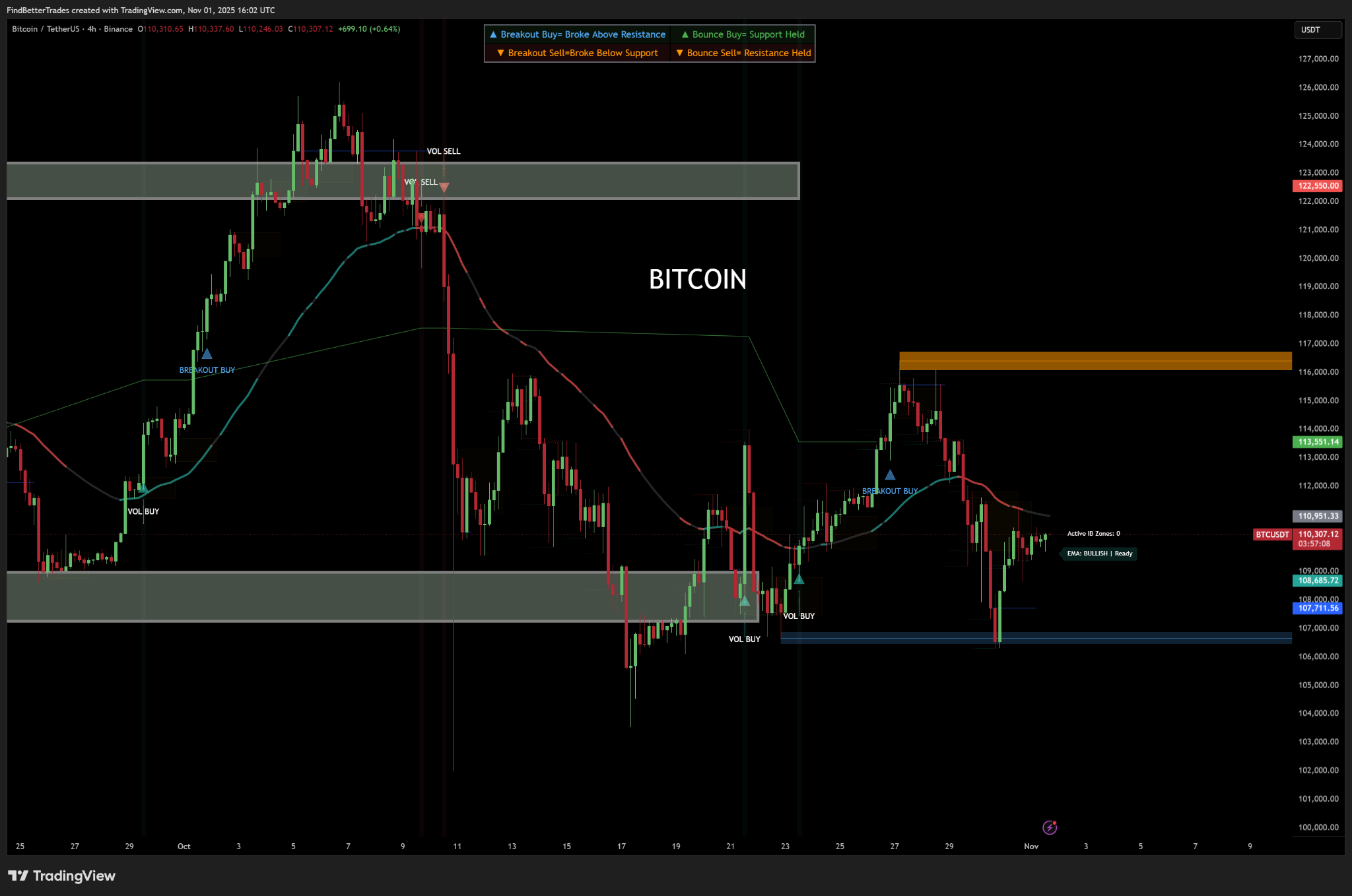

BITCOIN: Mixed Bias Below Resistance

Bitcoin gained 1.34% to $108,970 but traded in mixed bias. Expectations that the $106,000 level could be another level to be broken after creating resistance at the $111,000 level persist. For now, the cryptocurrency consolidates between these key levels.

Week Ahead: BOE and Budget Risk

Traders are pricing in rising odds of a BoE rate cut next week, though the British central bank is viewed as most likely keeping rates on hold. The real focus remains Reeves' November budget and its implications for UK economic activity.

With central banks diverging - the ECB pausing, the Fed divided, and the BOJ disappointing hawks - the dollar's dominance looks set to continue unless economic data shifts the narrative dramatically.

TriSignal Scanner members are already getting alerts on stocks, crypto, and forex. Meanwhile, you’re still deciding. This is it — your final Saturday with the 1-Year deal alive. 👉 Join now and start getting real signals today.

Kind regards,

FindBetterTrades